US stock futures point to a higher open on Wall Street Monday as the market continues its relentless climb back toward multi-year highs. On Friday, the market added to hefty pre-market gains until an afternoon sell-off tempered bullish enthusiasm. A promising jobs report Friday provided further fuel for this recovering market. The Russell 2000 small-cap index has actually already made new highs, a potentially bullish sign. The big enigma remains oil, which is now at two-and-a-half year highs around $108 per barrel, driven by more violence in Libya, continued unrest in Yemen, and overall destabilization of the world’s foremost oil producing region. The other issue is the potential of interest rate hikes if the upward trajectory of employment begins to accelerate. Three members of the FOMC are on record with hawkish comments, and hikes would be a game-changer as others have mooted possible QE 3, 4 … 10.

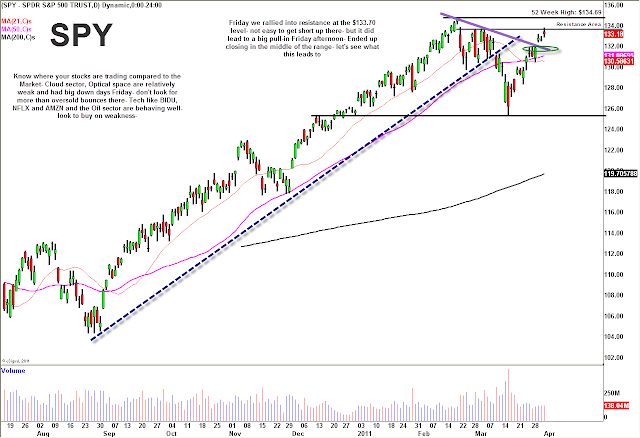

Technically, although the market had another sneaky late-day pull-in Friday, it remains strong. The key to trading this market is not guessing its direction, but rather identifying relative strength and weakness and being patient. It seems evident that the market does want to get back to highs, but the road to getting there could not be completely straightforward. The cloud sector, optical networking stocks and banks have all been relatively weak, while most of tech and oil sectors have shown relative strength. During this snap-back, the market has stalled out at each resistance zone pertaining to the wedge pattern from February, and Friday the top end of that range held. This morning we are set to open above it, though, so watch early to see whether we pull in or blast off. Above that $133.70 resistance area there is nothing in the way back to highs.

For more market and stock commentary, watch the T3Live.com Morning Call video with Scott Redler and Alix Steel, below.

As far as stocks on the radar this morning, gold and silver stocks are up big this morning as they continue their unstoppable run. Gold is becoming firmly established as an alternative currency in the new world of volatile forex prices, while silver, which has continually outperformed gold over the past few years, doubles as a store of value and industrial metal. Demand for gold, silver and copper is largely being driven by China, which is seeking to become independent on each front. iShares Silver Trust ETF (SLV) is set to open at all-time highs, while the SPDR Gold Trust ETF (GLD) will open near closing highs.

Chinese Stocks

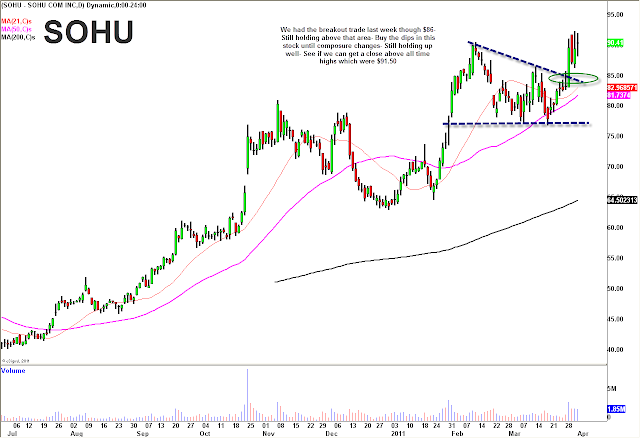

Last week one of the biggest winners among Morning Call plays was Sohu.com, Inc. (SOHU) which blasted off Tuesday. The stock pulled in hard Wednesday, but quickly erased those losses over the next two days. The resilience of this stock, even though the ranges have been large, shows it is relatively strong and wants to go higher. Look to continue to buy the dips in this stock until the composure changes, but there is a lot of excitement surrounding this company.

Another tech stock with a similar type of chart is OmniVision Technologies, Inc. (OVTI), a producer of semi-conductor image-sensor devices. Much like SOHU, OVTI broke out Tuesday before trading back and forth in a wide range the rest of the week. However, the stock held its break-out price and despite pulling in Friday, closed at the upper end of Tuesday’s breakout. This is another tech stock that looks like it has more juice.

The Weak Side of Tech

While most of the tech sector has shown relative strength during this rally, there have been some notable exceptions. The most obvious example that comes to mind at this stage is Research in Motion Limited (RIMM), which seems to be a fading company and a broken chart. While there still remain loyal Blackberry users, the success of Apple’s iPhone and the glut of well-regarded Google Android-powered smartphones has begun to render the company’s offerings somewhat obsolete. Some have suggested the PlayBook tablet could be a gamechanger for RIMM, but the dominance of Apple and Android powered tablets in what still is only a niche market still provides little hope for RIMM.

After a weak earnings report a few weeks ago, RIMM has a troubling chart to match its sagging fortunes. The stock was unable to eat into its large earnings gap down, and closed at the bottom of the recent range Friday. If RIMM breaks that $55.77 level, it’s look out below. The first level of minor support is $55, and then $50 looks like the next stop for the stock. If you want to balance out your portfolio with some shorts, RIMM is your best bet.

Oil in Focus

The United States Oil Fund LP (USO) made new multi-year highs again Friday as oil prices are back on the run, driven continued unrest and violence in the oil-rich Middle East and North African region. The oil servicers don’t move in lock-step with oil prices, and made their move back to highs earlier in the week. However, there was no momentum breakout late in the week as the Oil Service HOLDRs ETF (OIH) simply held in at highs Wednesday, Thursday, and Friday. The OIH usually trades well out of multi-day consolidations, and we will be looking for it to get some momentum on a break above the $167 level.

*DISCLOSURE: Scott Redler is long GLD, V, BA, BAC, XOM, JPM, POT, NYX, GOOG, OVTI, TIVO, SOHU. Short SPY.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.