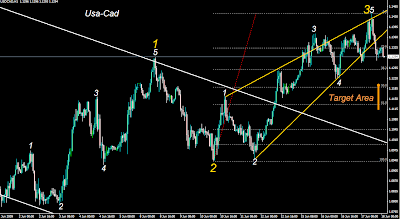

18.6 – 2009,

1) First UsaCad Drop with minimum to the 50% line, possibility to 61.8% line. This is very short lived rally setup for Eurodollar.

2) After it´s placed, UsaCad rally to the 1.5500 level, EuroDollar drop deep down, 1,3400 – 1,3600 level. Second one as priority target.

3) Then, it´s time to look again eurodollar rally to 1,4500-1,5100 area to end daily triangle. It´s not well finished in here. W-X-Y-X-Z is the ZigZag impulse I am looking meaning we will mark X for next corrective bottom.

Once the daily triangle is set, this party is over and we are allready perhaps in next autumn, but it´s a bit too early to look that far yet.

However, this should be very short lived setup now (2-5 days). EuroDollar rally higher than 1,4110 would terminate this setup.

I have positions open for this setup now as UsaCad broke the key line and positive sure it is bear diagonal issue, but it´s not fifth wave, it´s either C or W3 roof we placed on there. This is based for 60 min charts and terminates my previous eurodollar 1,3960 (top) target. Looking higher price (to reverse also).

Generally this should mean short lived bearish times to come, if not in this week, then next. If UsaCad takes now C down from here, it could be furious movement to reverse and push W-C2 corrective lonely lower top for eurodollar…