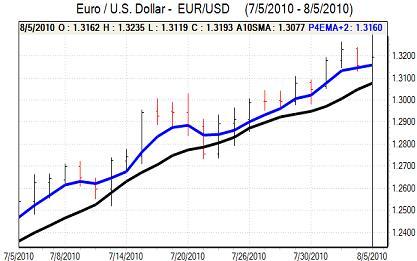

EUR/USD

The Euro dipped to lows near 1.3120 against the dollar in early Europe on Thursday before finding support. A favourable Spanish auction outcome and robust German industrial orders data helped trigger a revival in the currency to test resistance levels above 1.32.

The ECB left interest rates at 1.0% following the latest council meeting. ECB President Trichet stated that he was surprised at the recent strength of growth indicators and warned that the recovery was likely to be uneven over the next few months. Trichet also commented that the bank was looking to phase out extraordinary liquidity measures which provided some degree of Euro support.

The US employment data was weaker than expected with jobless claims rising to 479,000 in the latest week from a revised 460,000 previously. This was the highest figure since April and will maintain doubts over the US economy. There is also likely to be a downgrading of expectations surrounding the Friday payroll report.

Markets are expecting a further modest drop in the headline payroll data as temporary census workers continue to leave government payrolls. Following the jobless claims data, markets may be more tolerant of a slightly weaker headline figure, but any decline in excess of 150,000 would reinforce a lack of confidence in the economy and unsettle the dollar.

The Euro was unable to break above the 1.3220 area and retreated to re-test support, but the dollar was unable to make much headway ahead of Friday’s payroll data.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japanese trade Minister Naoshima warned over the impact of a strong yen and there will inevitably be further speculation that the authorities will look to intervene to prevent any yen gains beyond the 85 area against the dollar.

The yen resisted selling pressure on Thursday despite some evidence of retail selling and there will be expectations that a reduction in leverage on margin accounts will tend to put upward pressure on the Japanese currency. There was also some unease over the Chinese banking sector which lessened any selling pressure on the yen and the dollar was unable to break above the 86.50 area during the Asian session.

Higher than expected jobless claims data undermined the dollar in US trading and it retreated to lows near 85.70 before stabilising. A weaker than expected US payroll report on Friday would trigger renewed selling pressure on the US currency.

Sterling

Sterling weakened in European trading on Thursday, undermined in part by disappointment with the latest Barclays profit statement and tested support below 1.5850 before recovering.

As expected, the Bank of England left interest rates on hold at 0.50% following the latest policy meeting with the quantitative easing bond purchases also left unchanged at GBP200bn.

According to its normal practice, the bank did not issue a further statement with the rate decision. The minutes will, therefore, be very watched very closely when they are released in two week’s time. In particular, markets will look to see how many members, if any, voted for an increase in rates.

The central bank inflation report will also be extremely important for Sterling sentiment next week with markets extremely anxious to assess the balance of inflation and growth forces within the report.

Sterling hit further resistance above the 1.59 level against the dollar, but found support close to 1.5820.

Swiss franc

The dollar was unable to make any headway against the franc on Thursday and retreated to lows near 1.0415 before consolidating close to 1.0450. The Euro was unable to break resistance levels above 1.5820 against the Swiss currency with support close to the 1.3750 area.

Selling pressure on the Swiss currency remained limited even though there was a generally supportive testimony on the Euro-zone from ECB President Trichet.

The franc is likely to gain some support if there is a weaker than expected US payroll report on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

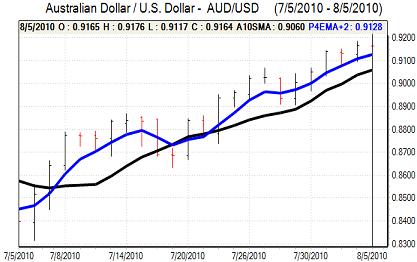

Australian dollar

The Australian dollar was unable to make headway in Asian trading on Friday and drifted lower in Europe with a test of support close to the 0.9110 level against the dollar. There will tend to be caution ahead of the US employment data and it will be difficult for the Australian dollar to make further headway ahead of the release.

There will also be some doubts over the Australian economy following the recent PMI data which will tend to curb buying support for the currency. Nevertheless, the currency was able to recover back to the 0.9155 area later in the US session as underlying sentiment remained firm.