Now that the debt debate is a done deal, the big question weighing on the markets is economic growth—or lack thereof. Given weakness recent manufacturing and spending data, as well as a continued gloomy employment and housing picture, market participants are weighing in on whether a double-dip recession might be ahead.

What’s a “double-dip” recession? A recession is formally defined as two quarters of negative gross domestic product (GDP). A double-dip would be a return to negative GDP after a positive quarter or two of growth. Right now, market action seems to be suggesting this is a real possibility. But let’s look at what the charts are showing, and the fundamental data.

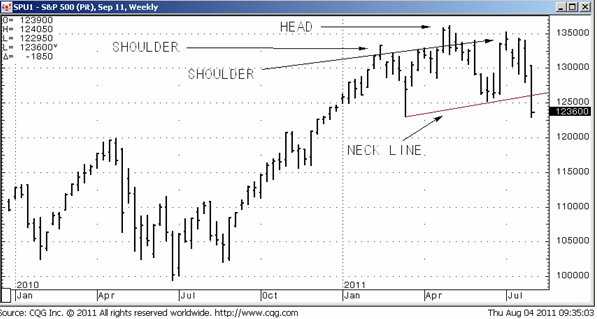

Let’s look at a chart of the S&P as a gauge of market sentiment about the economy. On Tuesday, August 2, the S&P 500 saw its biggest one-day drop in a year and is now down about 1.5 percent for 2011. We can see how the chart reflected a big change in psychology from spring to summer. The market broke violently. From a technical standpoint, the S&P 500 futures have now fallen through their 200-day moving average, and I can see a bearish head-and-shoulders top formation on the charts. This formation projects a move down to 1,150 is possible.

The stock market was in a huge bull market for much of the year without the housing market participating, and without a significant improvement in the labor market. We knew housing was bad. We knew employment was bad. However, in recent weeks, the market really started to get spooked. Some of it has been tied to uncertainty over whether the U.S. debt ceiling would get extended. Politicians almost didn’t beat the August 2 deadline, and it even though they reached an agreement, it looks like they didn’t really fix the long-term deficit issues.

Corporate America is doing pretty darn good, as reflected in the latest earnings reports. As of Wednesday, August 3, 384 out of the 500 companies in the S&P 500 had reported quarterly earnings, and 274 had topped analysts’ expectations. But companies aren’t hiring; they are hoarding cash. They are lean and mean. They can’t anticipate what the tax laws will be, and what their healthcare and other costs may be while Congress continues to debate these issues. There is too much political uncertainty. When Congress agreed to increase the debt ceiling, a committee was to be set up to make further reductions into the future. What will the committee come up with? What will the changes be to get this accomplished?

Risk is clearly off in the markets. Participants are scared of recession. If it comes, the stock market will move a lot lower. If we don’t see more than 100,000 in non-farm payroll gains in the July employment report (due out Friday, August 5) there will be disappointment. We need positive news, and this week’s economic data didn’t deliver. U.S. Department of Commerce datashowed U.S. consumer spending unexpectedly fell in June for the first time in two years, while personal income rose 0.1 percent, the smallest increase since November 2010. Meanwhile, the Institute of Supply Managementreported what while still indicating expansion, its manufacturing index dropped 4.4 points to 50.9 percent in June, the worst reading since July 2009. The ISM’s services index dropped to 52.7 from 53.3 in June. Rating agencies Moody’s and Fitch both warned that a downgrade to the U.S. credit rating is still possible if lawmakers fail to follow through on debt reduction measures, and economic data worsen further.

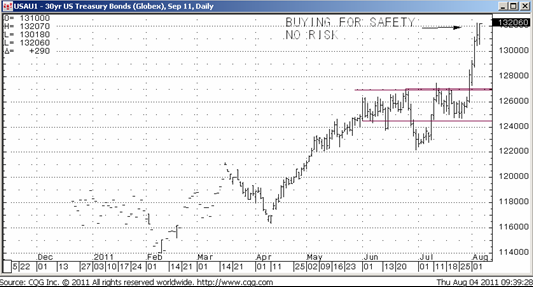

If investors are worried about recession, what does that mean for Treasuries? Treasury prices would go up, and yields move down. That’s exactly what’s been happening. You can see the big spike in price on the chart of the 30-year Treasury bond. This is a dramatic move that would typically take weeks or months, not days. This week, the yield on the cash 30-year bond slipped below 3.8 percent for the first time since October 2010. This market is acting like we are going into recession and there is no way out. It’s like a car with no brakes it can’t be stopped. I’m not so sure a return to recession is inevitable, but we’ll see what the upcoming data hold.

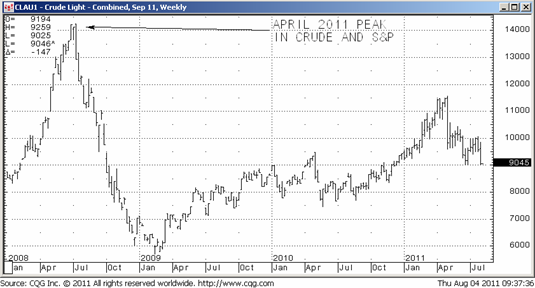

Commodities

Crude oil has also seen an impact of this risk-off, global slowdown trade. When things are looking good, consumers are spending. When the stock market rises, crude oil rises too because more people are driving, flying, and buying goods that are being shipped. Looking back to April, we can see how the S&P 500 had peaked in conjunction with oil’s peak above $100 a barrel. Is it a coincidence? No.

If investors are moving out of what’s perceived to be risky assets such as stocks and oil, they are turning to gold, which has extended its all-time high to above $1,666 an ounce this week. If things keep going the way they are now, gold should hit $1,700 fairly easily. Central banks are racing to purchase gold. The Swiss franc has been another safe haven for investor dollars, becoming the currency of choice. A year ago, the Swiss franc was trading at 0.90, and it’s now at $1.30. That’s a 40 percent increase. That represents safety. The Swiss National Bank took a few interventional measures to help push the Swiss franc down this week, but it didn’t work for long—the dollar remains near a record low against the franc.

The markets do seem to be predicting a high probability of recession. I don’t know for sure whether this will happen. The talking heads will be discussing this possibility in the near-term. Employment is going to be the key piece of the puzzle. The advice I can offer traders is to be nimble, and exercise proper risk-management. Watch the economic reports, and watch the action in these key markets for clues.

These are my general thoughts and trading ideas at this point in time, and not to be taken as specific trading recommendations. These ideas may change at any time as conditions change in the markets. For more specific strategies tailored to your unique risk tolerance and goals, I encourage you to contact me.

Jeff Friedman is a Senior Market Strategist with MF Global. He can be reached at 866-231-7811 or via email at jfriedman@mfglobal.com. Listen to more comments from Jeff on this topic in a webinar conducted August 3, 2011.

Futures trading involves substantial risk of loss and is not suitable for all investors. (c) MF Global Holdings Ltd. All Rights Reserved. Futures Traders, Commodity Brokers and Online Futures Trading. 141 W. Jackson Blvd. 1400-A, Chicago IL 60604. 800-445-2000.