By: Evan Lazarus

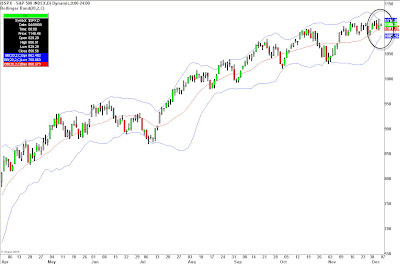

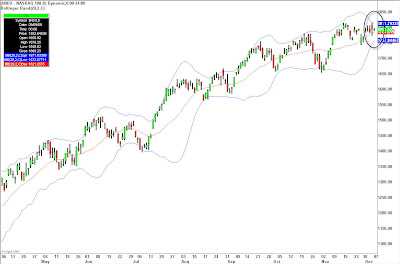

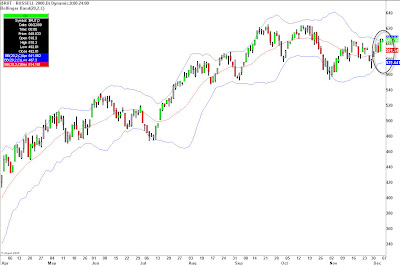

A trading strategy that many traders use for locating momentum trades is to watch when the Bollinger Bands for a particular market or stock “pinch” together. In this instance, one of the factors relevant to the change in character is a period of lower volatility prior to the establishment of a new trend. The price consolidation in the stock should result in a pinching or contraction of the bands. Think of this as a coiled spring preparing to explode.

We can see a “pinch” beginning to take place across all major market indices and traders need to be alert as to how this pinch may lead to a momentum style breakout or breakdown. Such volatility contractions tend to happen at key market inflection points and can generate powerful moves. Take a look at the charts below:

The S&P:

The NASDAQ: