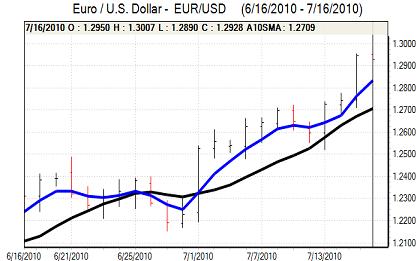

EUR/USD

The Euro maintained a firm tone in European trading on Friday as markets continued to challenge resistance levels in an attempt to trigger fresh stop-loss Euro buying and a closing of dollar positions. A wider than expected Euro-zone trade deficit did not have a significant market impact.

The headline US consumer inflation data was slightly weaker than expected with a headline 0.1% for June as energy prices declined, but the core increase was firm at 0.2%. The data overall will maintain expectations that the Fed will not be in a position to increase interest rates in the near term. The Euro pushed to a high just above 1.30 against the dollar which was the highest level since early May before meeting tough resistance.

The University of Michigan consumer confidence index was sharply weaker than expected with a decline to 66.5 from 76 the previous month. The data reinforced unease over US economic prospects with particular unease over the spending outlook.

Risk appetite deteriorated following the confidence data and this also provided some degree of dollar protection as confidence in the global economy also deteriorated. The Euro was over-bought after strong gains over the previous 48 hours, leaving it vulnerable to a technical correction with a slide to the 1.2930 area.

The latest speculative positioning data also recorded a net short dollar position for the first time since March will limit the scope for further Euro gains on position adjustment.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The weaker equity markets in Asia helped underpin the Japanese currency on Friday. The commodity currencies were also generally fragile which helped curb any carry-related yen selling.

The Japanese services-sector growth data was weaker than expected which will maintain unease over the economy and there will be speculation that the Finance Ministry will block further gains for the currency. The dollar continued to test support levels just below 87 in Asian trading on Friday as dollar demand remained weaker.

Dollar yield support declined following the US data which curbed US currency support on yield grounds. There was also a spike in risk aversion which pushed the yen stronger on the crosses with particularly sharp gains against Sterling and the dollar dipped to lows near 86.25 before a recovery to the 86.80 area.

Sterling

The UK currency held firm in early Europe on Friday with a further challenge on resistance levels above 1.54 against the US dollar. Sterling was unable to hold its best levels and steadily weakened during the day.

There were no significant domestic economic developments and trends in risk appetite were important. There were increased doubts over the global during the day which had some negative impact on the UK currency and the impact intensified following the weaker than expected US consumer confidence data.

In this environment, Sterling weakened to lows just below 1.53 against the dollar before consolidating just above this level late in the US session. The UK currency also weakened to six-week lows beyond 0.8450 against the Euro.

The MPC minutes and second-quarter GDP estimates will be watched closely during next week for further evidence on likely interest rate trends and Sterling is liable to be volatile.

Swiss franc

The dollar found support close to 1.04 in European trading on Friday and was able to secure an improved performance during the New York session with a peak around 1.0540. The Euro continued to make headway against the Swiss currency during the day with a sharp move early in the US session as the Euro probed resistance levels above 1.36 as Euro confidence continued to improve.

Swiss exporters have started to voice greater concerns over the impact of franc strength and there will still be pressure for the National Bank to curb franc gains, especially if there is any renewed decline in the US dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

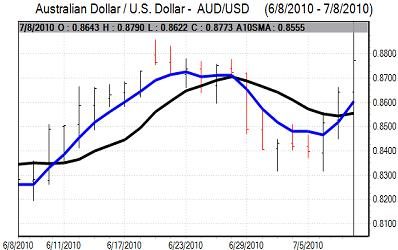

Australian dollar

Market conditions for the Australian dollar remained erratic during Friday, but there was significant Australian dollar weakness with a retreat back towards the 0.8760 area as global fears increased again.

There was a recovery back to the 0.88 level against the US currency during European trading, but the currency was subjected to renewed selling pressure in New York following the US data.

Unease over global trends and potential weakness on commodity prices will remain negative factors for the Australian currency, especially if there is further evidence of a global slowdown. Political factors will be watched closely, but should not have a major market impact over the next week.