EUR/USD

The Euro found support on dips to near 1.33 against the dollar on Thursday and recovered to near 1.3380, but rallies quickly attracted selling pressure as underlying confidence remained weak.

There were further Euro-zone stresses during the day as fears over the Irish economy persisted. There was also a widening of German Spanish yield spreads for the eighth successive day as markets continued to fret over the contagion risk. Spain will remain extremely important in the medium term as the Euro-zone members would find it much more difficult to fund any support package for the Spanish economy and there would be very real fears over a Euro break-up in the event of severe pressure on Spanish markets. There was also a further increase in European debt trading margin requirements which undermined Euro sentiment.

There was a significant shift in tone by political and central bank figures during the day. The French and German governments announced that the existing Euro support mechanisms would remain in place until 2013 as officials aimed to dampen fears that private bond-holders would need to share the burden on any future debt restructuring.

German Chancellor Merkel stated that the Euro will survive while Bundesbank head Weber commented that the Euro was a highly stable currency and not in danger. The comments suggest a coherent attempt to bolster Euro sentiment after the battering seen this week.

There were no significant US developments with markets closed for Thanksgiving and the Euro drifted back to test support in the 1.33 area in Asia on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support above 83.20 against the Japanese currency during Thursday and gradually moved stronger during the day with markets looking to attack resistance above 83.80.

There were further geo-political tensions with North Korea threatening to declare war over the South’s military exercises with the US this weekend. The simmering dispute will remain a negative yen factor, although the impact should be measured unless there is an escalation of the situation.

There was a headline rise in Japanese consumer prices in the year to October, primarily due to the impact of higher taxes and there was a continued decline in core prices. There will be continued pressure for yen gains to be resisted.

There was an increase in exporter dollar selling on the approach to 83.80 which tended to harden resistance levels, but the US currency nudged higher in Asia on Friday.

Sterling

Sterling was unable to make a challenge on levels above 1.58 against the dollar in early Europe on Thursday and maintained a generally weaker tone during the day.

In testimony to the Treasury Select Committee, Bank of England Governor King remained generally cautious over the economic outlook and also stated that a considerable amount of spare capacity within the economy would tend to hold down inflation. King also stated that there could be further quantitative easing if stronger exports failed to offset the impact of subdued domestic demand.

The other MPC members broadly maintained their recent approach to policy, although Posen did criticise the virtual endorsement of the government’s fiscal policies by King.

The generally dovish central bank stance pushed Sterling to lows below 1.5730 against the dollar and it was unable to secure much of a recovery later in the US session despite a firm tone in the latest CBI retail sales survey with Sterling dipping back towards 1.57 on Friday.

Swiss franc

The Euro found support below 1.33 against the franc on Thursday and edged firmer to the 1.3320 area, although gains were still limited. The dollar pushed to highs just above parity against the Swiss currency, but found it difficult to advance further.

Stronger rhetoric from Euro-zone officials may offer some respite to the Euro and limit immediate selling pressure, but there will still be a high degree of unease over the contagion threat and there is still the potential for significant defensive franc support.

The franc will be vulnerable to some selling pressure if the KOF index is weaker than expected as there will be pressure for the National Bank to curb currency gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

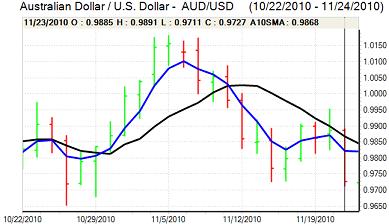

Australian dollar

The Australian dollar hit resistance close to 0.9850 against the US dollar on Thursday and there was fresh selling pressure in Asian trading on Friday with fresh weekly lows just below 0.9700.

Reserve Bank Governor Stevens stated in testimony to parliament that the level of interest rates was appropriate and the comments suggested that interest rates would not be increased further in the short term which will limit Australian dollar buying support.

There will still potential central bank reserve diversification into commodity-related currencies which should help limit selling pressure.