EUR/USD

The dollar remained under pressure during Tuesday as there was no relief from negative sentiment surrounding the US currency.

US debt negotiations continued on Tuesday and there was still no breakthrough. House of Representatives Speaker Boehner continued to push ahead with his plan for US$1trn in spending cuts and a short-term increase in the debt ceiling, but there was evidence of significant opposition within House Republicans and a vote may be delayed until Thursday after CBO analysis suggested savings would not meet the US$1.2trn savings claimed. There were signs that Senate Democrats would accept a bill which had no tax increases and this may present a route forward despite opposition from President Obama.

Markets continued to fret over the possibility of a debt default, although Treasury sources indicated that there would be some room for manoeuvre after the August 2nd deadline. It is also the case that markets, at this stage, are more worried over the threat of sovereign-rating downgrade by at least one of the major agencies. There is certainly a high risk that underlying damage caused by the default impasse will trigger a downgrade. Comments from Standard & Poor’s officials will be watched very closely in congressional testimony during Wednesday.

The US economic data did not have a major impact with consumer confidence rising slightly to 59.5 for July from 57.6 previously while there was a slightly weaker than expected new-home sales reading of 312,000. The Case-Shiller house-price index recorded a 4.5% decline an prices over the year to May.

Euro-zone developments remained of secondary importance, but there were still important moves as yield spreads widened again. Spanish yields were substantially higher at the latest bond auction which increased fears that there was still an important contagion threat. The Euro hit resistance near 1.4530 against the dollar, but there was support on dips to the 1.4470 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make any headway above 78.20 during Tuesday and dipped to lows near 77.70 as ranges were generally narrow. The dollar was unable to gain any support on fundamental grounds as the US debt-wrangling continued in Washington.

There was increased speculation over Bank of Japan intervention as the yen tested its strongest since March. Sources close to the Finance Ministry suggested that the chances of intervention were increasing strongly as fears over economic damage increased. At this stage, there is no evidence that there will be G7 intervention, but markets were inevitably on high alert over the situation.

There was also some speculation that there would be Bank of Japan quantitative easing to ease any pressure on the Japanese currency, but the dollar remained weak.

Sterling

Sterling edged slightly lower ahead of the UK GDP data on Tuesday, not helped by comments from Bank of England MPC member Weale that there could be a double-dip recession later in the year.

There was relief over a 0.2% quarterly increase which was in line with market expectations, especially given fears that there could have been a contraction. There were distortions caused by the Royal wedding and bank holidays with the ONS estimating that there could have been an underlying 0.7% increase for the quarter.

There will still be a lack of confidence in the growth outlook and there will be additional pressure on the government to change policies. Financial authority could also be damaged by further speculation over links between government officials and the phone-hacking scandal.

Dollar weakness was still the dominant influence as Sterling pushed to a six-week high above 1.6420 against the US currency while the Euro stalled above 0.8850.

Swiss franc

The Euro found some support below 1.1550 against the franc during Tuesday and rallied back above the 1.16 area as selling pressure eased to some extent. The dollar remained firmly on the defensive, but did manage to find support below the 0.80 level as it threatened fresh record lows

Selling pressure on the franc was limited by further doubts surrounding the Euro-zone peripheral economies as yield spreads widened again. Domestically, there was a decline in the UBS consumption index, maintaining the run of recent disappointing data, and there will be further pressure for direct National Bank action.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

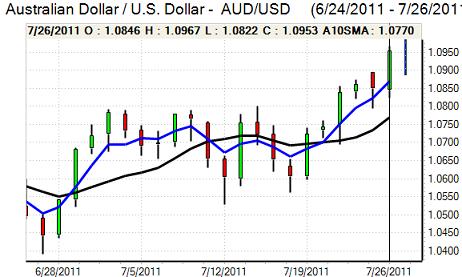

The Australian dollar resisted pressure for profit taking during Tuesday and consolidated close to the 1.0950 area in US trading. There was a fresh spike higher in local trading on Wednesday following the stronger than expected inflation data. Consumer prices rose 0.9% for the second quarter compared with expectations of a 0.7% rise with the underlying increase also higher than expected.

The data revived speculation that there could be a further tightening by the Reserve Bank. The Australian currency also drew support from continued demand as a safe-haven given fears over the US outlook.