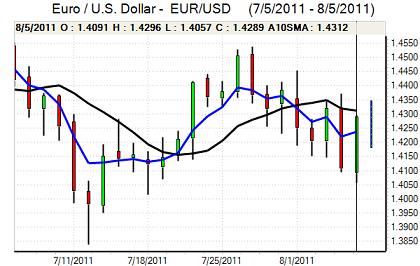

EUR/USD

There was an element of consolidation ahead of the US data on Friday with a reluctance to maintain aggressive positioning, especially given further Euro-zone turbulence. The headline employment data was slightly stronger than expected with a non-farm payroll increase of 117,000 for July after a revised 46,000 increase the previous month while the unemployment rate dipped to 9.1% from 9.2%. Job creation was still lacklustre and there was a further significant decline in government employment.

There was further speculation that the Federal Reserve move towards additional quantitative easing given the weak data and markets were already on alert ahead of Tuesday’s FOMC meeting.

The employment data was over-shadowed later in the US session by rumours of a US credit-rating downgrade and after the market close Standard & Poor’s confirmed that it has downgraded the sovereign rating to AA+ from AAA with a negative outlook. There was controversy over the decision with the ratings agency making base-line errors which distorted their calculations. The downgrading did undermine the dollar and US economic policies also came under attack from China.

Markets also had to contend with a volatile Euro-zone situation as underlying confidence continued to deteriorate amid rumours of capital flight from Italy. The ECB announced that it would consider buying Italian and Spanish bonds in the secondary market if Italy accelerated economic reform. In a series of emergency meetings, the Italian government pledged to accelerate reform and the ECB also announced over the weekend that it would buy bonds despite further signs of division within the Governing Council.

The combination of ECB support and US ratings downgrade pushed the Euro sharply higher at the Asian open on Monday, but it failed to sustain the gains as uncertainty remained extremely high with G7 pledging to stabilise markets after their own emergency discussions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar moved higher following the US employment data on Friday with relief over a slightly stronger than expected report triggering highs near 79, but it was unable to sustain the gains and drifted back to the 78.50 area.

There was an opening gap lower in Asia on Monday following the US credit-rating downgrade as confidence in the US fundamentals remained weak.

There were warnings over further intervention, but G7 members made no explicit reference to the dollar/yen rate in their weekend discussions. There were reports that last week’s Bank of Japan intervention was over JPY4trn and the central bank also announced that it won’t drain the funds from the money markets, maintaining a very high degree of yen liquidity.

The yen still gained important support from the wider deterioration in risk appetite with a test of support below 78 on Monday as regional bourses fell.

Sterling

UK events and Sterling again tended to be over-shadowed by news events in the US and Euro-zone during Friday. There was further nervousness surrounding the UK banking sector with weak results combined with further fears over a second credit crunch undermining confidence, especially given the potential impact on UK lending.

The Halifax house price index recorded a 0.3% increase in prices for July, but the Rightmove organisation reported a further deterioration in buying support from first-time buyers which maintained fears over the underlying housing outlook with a lack of volume.

As the US currency came under pressure, Sterling rallied from below 1.63 to highs near 1.6480 before retreating again as volatility remained high. ECB action to support the Italian and Spanish markets would tend to ease banking-sector fears, at least in the short term, which would also underpin Sterling, but there will still be fears over the UK and international growth outlook.

Swiss franc

The dollar was unable to make any sustained headway against the franc during Friday with resistance above 0.77 as underlying demand for safe-haven currencies remained strong.

There was fresh demand for the Swiss currency following the US credit-rating downgrade as risk appetite continued to deteriorate and a G7 pledge that they were willing to stabilise markets also failed to provide lasting support for the dollar. The US currency spiked lower to test record lows below 0.7550 in Asia on Monday before finding some support. National Bank policy actions will remain under very close focus due to speculation over intervention or other direct measures to curb the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

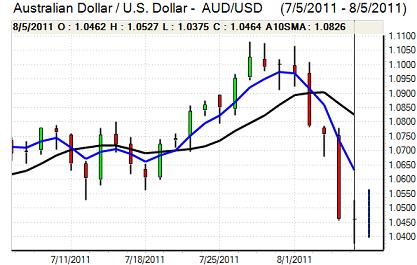

Australian dollar

The Australian dollar hit resistance above 1.0520 against the dollar in choppy trading on Friday and briefly tested support below 1.04. There was renewed selling pressure on the currency in Asian trading on Monday as underlying risk appetite continued to deteriorate.

The domestic data provided no support with a decline in job ads, although international trends tended to dominate. There were increased fears surrounding the global economy and, after some initial resilience, there was also a sharp downward move in Asian equity markets which fuelled additional selling pressure on the Australian currency with four-month lows just above 1.03.