The news of the day for commodities was Goldman Sachs’ shift to the bullish side in raw materials. The firm said “we now believe that the risk/reward once again favors being long commodities,” adding that they were shifting to a near-to-medium term overweight recommendation and were bullish markets including oil, copper, zinc and cotton. Nonetheless, grains faced some semi-serious selling amid other near-term fundamental concerns.

Wheat futures closed down 23 ¼ cents a bushel at $7.79 3/4 on Tuesday, May 24, 2011, while corn closed down 20 ¾ cents at $7.33 1/4 a bushel and soybeans were down $1.25 at $13.72 1/4 a bushel. Planted acres, while behind ideal, have been making progress. According to the latest USDA/NASS Crop Progress report, as of Sunday, May 22, 79 percent of the nation’s corn crop has been planted, while 41 percent of the nation’s soybean crop has been planted. I agree with Goldman’s assessment that sustained high crop prices are likely to continue, but that doesn’t mean we won’t see pullbacks in these markets.

The bull market in corn started a little less than a year ago, but it hasn’t been straight up, as you can see in the chart. It hasn’t been easy to be long this market given the volatility.

The spread between old crop-new crop is something traders should keep an eye on in a bull market like this one. When the spread failed to make new highs near $7.80, it was a warning sign, and the break that ensued was more severe in the spread than the market itself. You would expect the front-month, which has tighter supply, to outperform, and it did. This spread pulled back in recent days from the top of the range.

As a trading strategy, you might want to consider buying at-money-calls on the recent break in front-moth corn. The market has seen a substantial break and I think there is a good change for one more move up.

The spread should see support at the 50 percent and 61.8 percent Fibonacci retracement levels, represented by the dark blue and red lines on the chart. There is not a lot of time left to be in July corn, and short crops have long tails. Even though the market has falling today, there could be a late month-push depending on weather.

Wheat

The wheat market has seen some added pressure from news reports that Russia is likely to resume exports July 1, which had been suspended a year ago. We haven’t had a perfect hard winter wheat crop, and farmers have had a tough time getting the spring wheat in the ground. However, there is still time to do so. Wheat futures broke bear-tern support at $7.88, but as long as the market stays above $7.65 I don’t see a meltdown. Keep in mind, the winter wheat harvest begins in two-three weeks, which can bring some volatility.

Soybeans

Soybeans, which typically are more volatile than corn or wheat, have been more contained. The crop is a bit behind in terms of planting, but there is still time to get soybeans in the ground. China’s soybean imports fell for a third month in a row in April, and soybean stocks are near historic high levels. I don’t think demand will push soybeans higher, but adverse weather could fuel a rally toward the end of the summer. We do need every acre we can get in both corn and soybeans. Trading has been active over the winter for grains, perhaps the most active we’ve seen in many years. So I still see plenty of opportunities in these markets for traders.

Euro

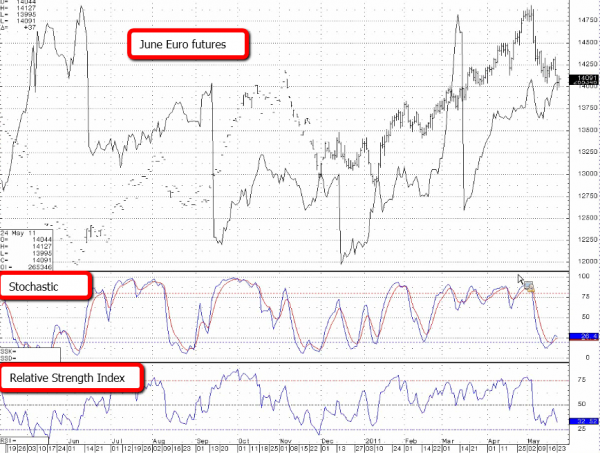

You can’t avoid reading about Europe and its debt problems, which has influenced nearly all markets, including commodities. Commodities are priced in U.S. dollars, so currency differentials are important to these markets. It all sounds like the end of the world sometimes. The news is bad, bad, bad. The last break under $1.40 in the June euro futures have not generated much renewed selling interest. Perhaps some of the bearishness has ebbed, and you don’t want to trade off every headline. Pay attention to the technicals. No matter which way you want to trade the market, I believe it’s important to determine your stops before you enter a position. Be patient, and disciplined, and have realistic expectations.

Jim Barrett is a Senior Market Strategist with Lind-Waldock. He can be reached at 866-419-7698 or via email at jbarrett@lind-waldock.com.

Futures trading involves substantial risk of loss and is not suitable for all investors.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Lind-Waldock, 141 W. Jackson Blvd, 1400-A, Chicago IL 60202. 800-445-2000.