EUR/USD

The Euro pushed higher again in European trading on Friday, but it was unable to break above the 1.4880 level and was generally weaker in US trading, although choppy trading conditions prevailed.

The US economic data did not have a major impact with the latest Chicago PMI index slightly weaker than expected, but still comfortably above the long-term average at 67.6 for April while the final University of Michigan consumer confidence index was marginally firmer.

US Treasury Secretary Geithner re-affirmed the US strong dollar policy, but the impact was negligible as markets will need a much more decisive set of comments from the US Administration and wider G7 officials before taking notice. Nevertheless, there was some degree of caution in the market and the Euro weakened to the 1.48 area late in US trading.

Markets will also be on high alert over currency-related comments from Euro-zone officials ahead of Thursday’s central bank meeting. There will certainly be unease over the impact of Euro strength and there will be the potential for a more concerted attempt to talk the Euro down and convince the ECB that it needs to take a softer tone.

The Euro was again subjected to volatile trading in Asia on Monday and retreated to lows near 1.4760 before stabilising with rapid moves in gold and silver exacerbating volatility. The latest IMM data recorded the largest net long Euro position for 40 months which will maintain the potential for a sharp correction and the dollar also gained some support from the announcement that Osama bin laden had been killed.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to gain nay traction against the yen during Friday and dipped to lows near 81.00 in Asia on Monday before finding support and rebounding to the 81.50 area. The yen will remain a primary instrument for funding carry trades and any sharp reversal in commodity prices, for example, would also trigger a closing of carry trade positions which would tend to boost the Japanese currency.

Underlying confidence in the Japanese economy is liable to remain very weak with Bank of Japan Governor Shirakawa, for example, stating that the outlook was very severe. There will be further speculation over longer-term capital outflows from Japan which will tend to undermine the currency. Japanese markets were closed for a holiday on Monday.

Sterling

Sterling found support closer to 1.6620 against the dollar during Friday and pushed to a peak around 1.6725 late in the US session. Liquidity remained low with UK markets closed for a Holiday weekend and the UK currency was also influenced strongly by US dollar moves.

The Bank of England will announce its latest interest rate decision this Thursday and markets are not expecting rates to be increased. There will still be some caution ahead of the decision which should curb any selling pressure.

The UK currency will also still gain important protection from unease surrounding the Euro-zone together with a persistent lack of confidence in the dollar. With UK markets again due to be closed for a holiday on Monday, Sterling retreated to the 1.6670 area as the dollar secured some respite.

Swiss franc

The dollar remained under heavy selling pressure against the Swiss franc during Friday and hit a succession of record lows with a trough around 0.8625 in early Asia on Monday before a tentative recovery.

Swiss National Bank President Hildebrand warned over the negative impact of franc strength, but he also cautioned that there were upside risks to inflation which tended to lessen speculation over any near-term move to weaken the currency.

The franc maintained a strong tone on the crosses, reaffirming its position as the dominant safe-haven global currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

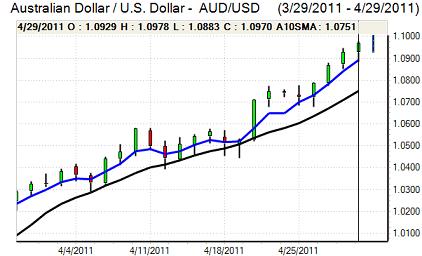

Australian dollar

The Australian dollar found support close to 1.0880 against the US currency during Friday and advanced steadily to a peak in the 1.0960 area. The currency was undermined briefly by a sharp drop in silver prices at the Asian open, but there was a fresh surge higher later in the session with a brief advance to the 1.10 area before a more substantial correction weaker.

The housing data was weaker than expected with a quarterly decline and underlying confidence in the housing sector is liable to remain weaker. The Reserve Bank interest rate decision is due on Tuesday and there will be some caution ahead of the decision given the risk of central bank reservations over currency strength in the policy statement.