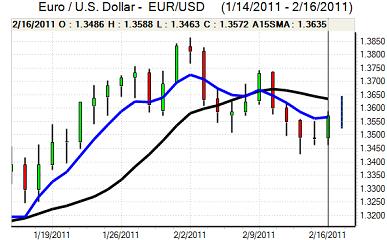

EUR/USD

The Euro retreated to re-test support below 1.3480 against the dollar during Wednesday, but the US currency was unable to sustain an advance and the Euro pushed back strongly to a high just above 1.36 in Asia on Thursday. There were further reports of central bank Euro buying which made it more difficult for the dollar to make headway.

The US housing data was mixed as a larger than expected increase in starts was offset by a decline in permits to an annual rate of 0.56mn from 0.63mn the previous month. The industrial data was also significantly weaker than expected with a 0.1% output decline for January compared with expectations of a 0.5% monthly increase.

The Federal Reserve FOMC minutes confirmed the statement that the Fed was more optimistic over the economic outlook, but there were also further references to unemployment being too high and there were still no indications that the Fed would move towards a tighter policy.

There was a renewed increase in Middle East tensions during the day as Iran stated that it would be sending Navy ships through the Suez canal and there were further political protests across the region. The dollar failed to draw any defensive support from the tensions, but any intensification of the disputes would still tend to support the US currency, especially as there would be a flow of funds away from emerging markets.

There were no major Euro-zone developments during the day with the German government nominating Weidmann to replace Weber as Bundesbank head. Markets will continue to monitor Euro-zone yield spreads closely as underlying confidence remains weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high just below 84.0 against the yen during Wednesday, but it was unable to make a serious challenge on resistance above this level and retreated back to the 83.55 area later in the US session.

Yield considerations remained important and the dollar was unable to gain sustained support from higher than expected producer-price inflation as growth optimism was curbed by the weaker industrial data.

Risk appetite will also remain an important factor and the yen will tend to gain support if there is any sustained increase in Middle East tensions. Underlying confidence in the Japanese fundamentals is liable to remain weak which will limit yen support.

Sterling

Sterling edged weaker following the UK employment data on Wednesday with the unemployment claimant count showing a small monthly increase compared with expectations of a decline.

The main focus was on the inflation report with the Bank of England raising its inflation forecasts at the same time as the GDP growth forecasts were lowered. Governor King was very anxious to emphasize that the bank does not endorse market interest rate expectations and he also cautioned that the pace of monetary tightening is liable to be slower than anticipated by markets.

King’s comments had a substantial impact with Sterling weakening sharply on a scaling back of 2011 rate increases even though the report still suggested that rates would be increased. Sterling retreated to test support below 1.60 against the dollar before rallying to 1.61 on a wider US decline.

Sterling sentiment will continue to fluctuate sharply, especially with a high degree of uncertainty over the impact of fiscal tightening on the economy.

Swiss franc

The franc retreated sharply in European trading on Wednesday as the government confirmed details of its plans to alleviate economic stresses from the strong franc with support for key areas such as tourism. The Euro failed to sustain a position above 1.31 and was subjected to renewed selling in New York. From a high above 0.9720, the dollar also fell sharply to lows near 0.9550 as the franc secured wider support.

The franc gained fresh support from an increase in Middle East tensions and fears that violence could escalate in the region. The franc will continue to be the principal global safe-haven currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

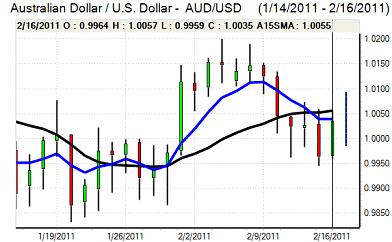

Australian dollar

The Australian dollar found support below 0.9960 against the US currency on Wednesday and advanced to a high near 1.0050, primarily due to wider US vulnerability during the New York trading session. There were no major domestic developments with trends in risk appetite and commodities important and the currency was still finding it difficult to gain any momentum.

Global equity markets have been broadly resilient which has helped underpin the Australian dollar, but the currency will be vulnerable if there is any escalation in Middle East tensions and there will also be fears that commodity prices could be vulnerable to further selling pressure.