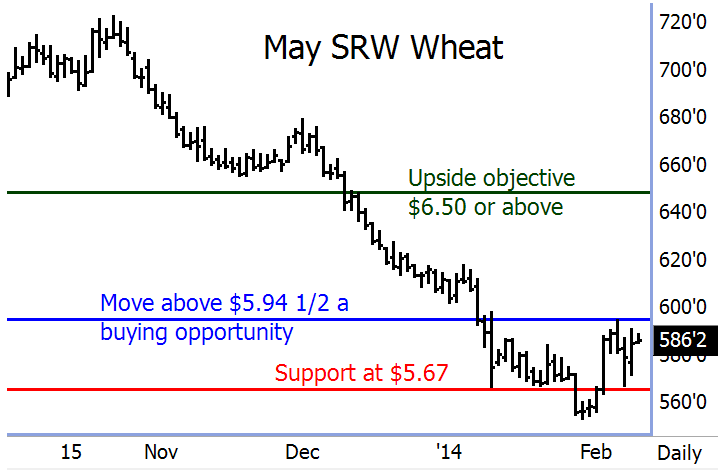

May SRW wheat futures a buying opportunity on more price strength.

See on the daily bar chart for May soft red winter wheat futures that prices have made a decent rebound from the contract low. Given the postures of other raw commodity markets (showing signs of major bottoms) and the fact that wheat has showed some price strength recently, it is my bias that wheat has likely put in a major market low. A move in prices above solid chart resistance at $5.94 1/2 would become a buying opportunity. The upside objective would be $6.50 or above. Technical support, for which to place a protective sell stop just below, is located at $5.67. Remember that the “mini” grain futures contracts are a liquid and viable way to trade the grain markets.