Just a reminder, these charts are posted as examples of the trades on the nightly COT Signals email. These trades will help illustrate the mechanics that go into creating the nightly email.

The U.S. Dollar is higher this morning and consequently, Gold is lower. Of the commodity markets with a high negative correlation to the U.S. Dollar, Gold has one individual advantage – it’s an inflation hedge rather than consumable commodity. Therefore, the reason for owning Gold against inflation still stands when the Dollar rallies while other commodity consumers will begin to seek substitute goods in the face of higher prices.

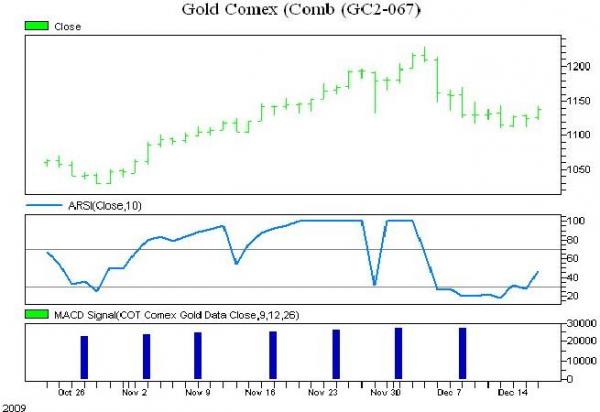

This brings us to our trade, which is purely mechanical in its signal generation. As the Dollar has rallied, we’ve seen commercial traders selling increase. Also, commercial trader momentum remains positive in the gold market. If the commercial traders succeed in their attempt to cap the Dollar’s rally, it would make this pullback in Gold a an opportune time to buy.

Yesterday, we saw an upturn from the support that had built up just above $1100. Using this number as support, we are going to buy Gold on this morning’s pullback. We have placed our protective stop at the recent swing low of $1110.20 and we will exit the market on a violation of this price level.

These trades are part of the “COT Signals” nightly email.

Any questions, please call.

866-990-0777.