August gold futures closed up $13.60 at $941.00 yesterday. Prices closed nearer the session high yesterday and were supported by solidly lower U.S. dollar. Trading has turned choppy again in gold. Prices are still in a four-week-old downtrend, but solid follow-through buying on Thursday and a bullish weekly high close would negate the downtrend and provide bulls with fresh upside technical momentum. Bears’ next downside price objective is closing prices below solid technical support at last week’s low of $913.20. Gold bulls’ next upside price objective is to push and close prices above solid technical resistance at last week’s high of $949.00. First resistance is seen at yesterday’s high of $947.00 and then at

$949.00. Support is seen at $935.00 and then at $930.00.

Wyckoff’s Market Rating: 5.5.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

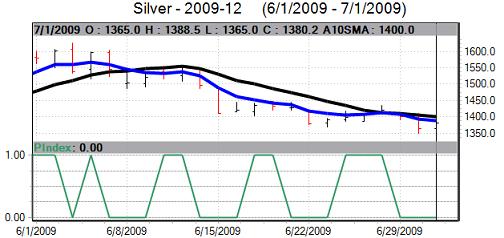

December silver futures closed up 16.6 cents at $13.74 an ounce yesterday. Prices closed near mid-range and were supported by short covering. Prices are still in a four-week-old downtrend on the daily bar chart. Bulls’ next upside price objective is closing prices above solid technical resistance at last week’s high of $14.315 an ounce. The next downside price objective for the bears is closing prices below solid technical support at $13.00. First resistance is seen at yesterday’s high of $13.85 and then at $14.00. Next support is seen at yesterday’s low of $13.59 and then at this week’s low of $13.435. Z

Wyckoff’s Market Rating: 4.5.

December N.Y. copper closed up 595 points at 234.00 cents yesterday. Prices closed near mid-range yesterday and did hit a fresh two-week high. The bulls have the near-term technical advantage. The next downside price objective for the bears is closing prices below solid technical support at last week’s low of 214.95 cents. Bulls’ next upside objective is pushing and closing prices above solid technical resistance at the June high of 246.80 cents. First support is seen at yesterday’s low of 230.50 cents and then at this week’s low of 225.20 cents. First resistance is seen at yesterday’s high of 237.65 cents and then at 240.00 cents.

Wyckoff’s Market Rating: 7.5.