Technical Setup

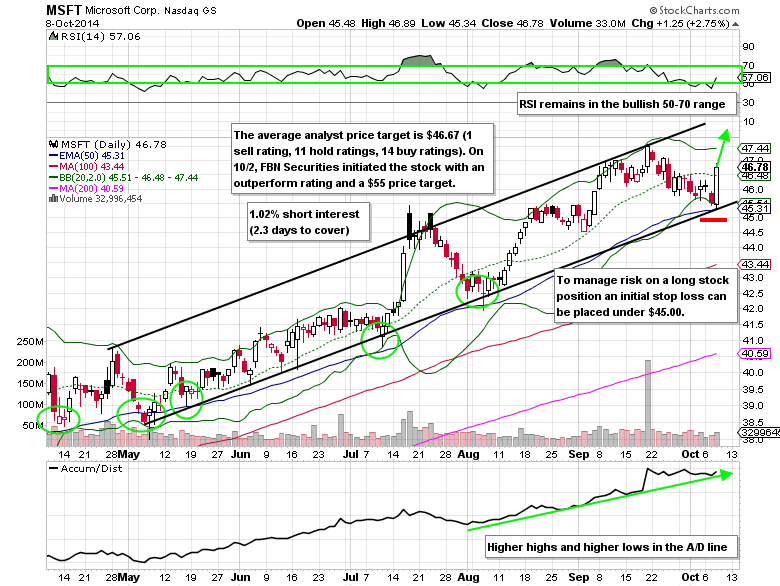

Shares of Microsoft (MSFT) have fallen about $2 in the last two weeks in a fairly orderly manner. This brought the stock back to major support at the 50-day exponential moving average, an area where it has marked bottoms for most of 2014. Despite Microsoft being up about 28% year to date, the uptrend remains intact and will at a minimum take the stock back to the September high of $47.57 and likely up to $50 by the end of the year. Both the relative strength index (RSI) —staying in the bullish 50-70 range— and the A/D line (higher highs and higher lows) are confirming the price action.

Valuation

Trading at a P/E ratio of 14.41x (2015 estimates) with 17.6% EPS growth, price to sales ratio of 4.32x, and a price to book ratio of 4.18x, Microsoft could still see upside before even trading at a PEG ratio of 1.00x (P/E ratio divided by EPS growth). The dividend is another positive given that the 2.6% yield is significantly than most tech stocks (The QQQ’s has a dividend yield less than 1%).

While Microsoft is a massive company ($385 billion market capitalization) the new CEO, Satya Nadella, is taking initiatives to keep the company going in the right direction. Recently, Microsoft announced the acquisition of Majong for $2.5 billion (the profitable Minecraft game developers) and is now offering Microsoft Office to the iPad to win back business professionals from competing apps.

First quarter earnings are due out on October 23. Shares of Microsoft have closed higher the day after earnings on four straight reports.

Options Activity

On August 18, 125,000 MSFT Nov 22 $40 calls were bought for $5.00-$5.15 each (now trade around $6.85). This trade along makes up over 10% of the total call open interest and by far has the largest open interest in the Nov 22 options expiration.

Microsoft Options Trade Idea

Buy the Nov 22 $47/$50 call spread for a $0.90 debit or better

(Buy the Nov 22 $47 call and sell the Nov 22 $50 call, all in one trade)

Stop loss- None

First upside target- $1.80

Second upside target- $2.80

= = =

Mitchell’s Smart Money Report for unusual options activity featuring Dow Chemical (DOW)