EUR/USD

The Euro held firm in Europe on Monday as the dollar remained vulnerable, but there was resistance above the 1.37 level.

The German economic data was stronger than expected as the IFO business confidence index rose to a record high of 111.2 for February from 110.6. There were also strong readings for the Euro-zone PMI manufacturing sector, although the services-sector data was less favourable. There will also be unease over the national breakdown with the risk that peripheral economies remain trapped in recession.

There was another elevated reading for bank borrowing through the ECB’s emergency lending facility and, even if this is related to a winding down of two Irish bank operations there will be further unease over the European banking sector.

US markets were closed for the President’s day holiday which curbed trading volumes during the day with very narrow ranges prevailing during US hours.

Middle East tensions were again a significant market factor and there was further violence in North Africa with a particular focus on Libya. There were signs that the dollar may now gain some support from the tensions given the possibility of a wider flow of funds out of emerging markets. Asian equity markets also dipped sharply on Tuesday which reinforced a more cautious attitude towards risk and also gave renewed support to the US currency.

With renewed fears over Euro-zone sovereign ratings, the Euro declined to test support below the 1.36 level on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was held close to 83.20 against the yen for much of Monday and dipped to lows near 82.85 in Asia on Tuesday before recovering to the 83.30 area. Former top financial official Sakakibara stated that the dollar was likely to weaken to below the 80 level which had some negative impact on the US currency.

A government upgrade to its view of the economy did not have a major market impact. There was also a measured reaction to Moody’s downgrading of Japan’s credit rating to negative watch from stable with the dollar spiking higher only briefly.

Risk conditions remained very important and the yen gained some significant defensive support from weaker Asian equity markets and unease over the geo-political situation in the Middle East as Iranian naval vessels entered the Suez Canal.

Sterling

Sterling held firm during European trading on Monday, but it was unable to strengthen above the 1.6250 area against the US currency.

Bank of England MPC member Weale again called for an early rise in interest rates to keep inflation under control for the medium term and prevent the necessity for larger rate increases at some point in the future. Weale had already voted for an increase in January so the comments did not surprise markets and he also stated that a small rise in rates would be appropriate.

There will be further near-term speculation over February’s vote split which will be announced in the MPC minutes on Wednesday and Sterling will gain some support if more than 3 members voted for an increase.

International market conditions will also remain an important factor and Sterling will be vulnerable to selling pressure if there is a sustained deterioration in risk appetite, especially if there is a further decline in confidence towards the banking sector. In this context, the Irish election at the end of this week will be watched very closely given the potential for a forced debt restructuring.

Swiss franc

The dollar found support close to 0.9450 against the franc during Monday and did rise to a high just above 0.95, but it was unable to sustain the advance as the Swiss currency gained fresh support on the crosses. The Euro weakened to test support below 1.2880 and there will be further defensive demand for the franc if risk appetite deteriorates further.

The National Bank actions will continue to be watched closely as renewed franc appreciation would increase potential fears over deflationary pressure within the economy and increase pressure for intervention.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

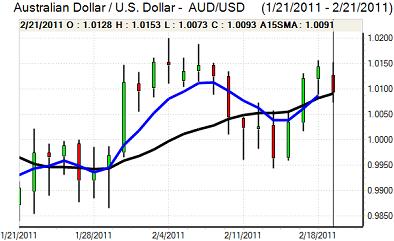

Australian dollar

The Australian dollar hit resistance below 1.0150 against the US currency on Monday and gradually drifted weaker during the day as markets were less comfortable with risk.

This trend accelerated in local trading on Tuesday with the Australian currency weakening to lows near parity as Asian equity markets declined. A weaker New Zealand dollar triggered by another earthquake also had some negative impact on the Australian currency. There looks to be little scope for additional support on domestic grounds and degrees of risk appetite will tend to remain dominant in the short term.