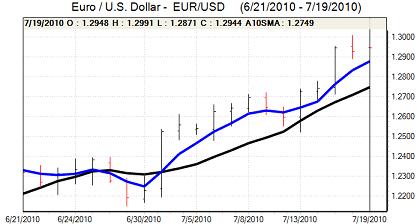

EUR/USD

The Euro had a soft tone in Asian trading on Monday and consolidated near 1.29. The Irish credit rating was downgraded to Aa2 from Aa1 by Moody’s, on persistent fiscal weakness, but the outlook was described as stable and the Euro corrected quickly from initial weakness. Sharp losses in Hungarian markets also failed to have a big negative impact on the Euro.

There was mixed sentiment surrounding the European bank stress-test results which are due to be released on Friday. Overall, there was a mood of cautious optimism over the outcome and this provided some degree of Euro support, but sentiment could quickly reverse if there are rumours that banks will need to raise substantial new capital.

The US housing data was again weaker than expected with the NAHB sentiment index dipping to 14 for July from a revised 16 previously and this was the lowest figure for 15 months. The data increased unease over the construction data on Tuesday and maintained a generally more cautious tone towards the US economy. Fed Chairman Bernanke is due to testify on monetary policy to congress on Wednesday and markets will be wary of a generally downbeat assessment by the Fed chief which will tend to limit dollar support.

The Euro moved back to the 1.30 area, but was unable to make a serious challenge on resistance levels. The latest speculative positioning data recorded a net short dollar position for the first time since March which will limit the scope for further Euro gains on position adjustment and it consolidated near 1.2940.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Japanese markets were closed for a holiday on Monday which curbed trading activity during Asian trading. There was still an underlying mood of caution towards risk which curbed activity in carry trades. Commodity currencies were also generally fragile which limited any selling pressure on the yen.

The dollar was unable to regain the 87 level and consolidated above 86.50 in early Europe. There were media reports that the Bank of Japan would take additional policy steps if the yen appreciates to the 85 area and there will also be further speculation over verbal intervention by the Finance Ministry.

The dollar strengthened to the 87.20 area, but was unable to sustain the gains even when Wall Street looked to move higher with US housing fears a negative influence on the dollar.

Sterling

The Rightmove house-price data recorded a 0.6% monthly decline for July which will maintain a sense of unease over housing trends. Sterling initially found support below 1.5280 against the dollar, but was unable to make much headway.

The currency remained generally on the defensive during the day with a low close to 1.52 against the dollar and also weakened to a 7-week low close to 0.85 against the Euro. The underlying lack of confidence in the global economy was important in curbing Sterling support.

The UK data will be watched closely during the week and will have an important impact on Sterling sentiment. The latest government borrowing data will be released on Tuesday and a higher than expected deficit figure would tend to undermine confidence in the currency.

Swiss franc

The franc remained on the defensive against the Euro during Monday and tested 1-month lows beyond 1.36. In this environment, the dollar was resilient against the Swiss currency and strengthened to a high near 1.0550.

There was a further improvement in confidence surrounding the Euro-zone financial sector and this helped limit demand for the Swiss franc. There will still be the risk of choppy trading conditions over the next few days, especially with the European bank stress tests due to be released on Friday, and Euro confidence could quickly be eroded.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

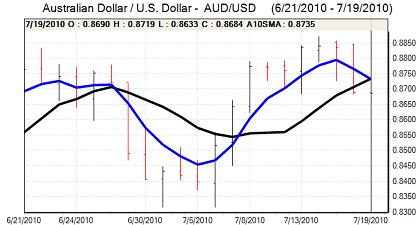

Australian dollar

Australian dollar selling pressure continued in local trading on Monday with lows close to 0.8630 against the US dollar. The US currency was unable to sustain the advance and the Australian currency rallied back to the 0.8710 region.

Volatility is likely to remain a key short-term market feature and there are likely to be very important doubts surrounding the global economy which will undermine Australian dollar support and it edged lower in early New York. Despite a rebound in equity markets, the Australian currency continued to hit resistance above 0.87 later in the US session.