EUR/USD

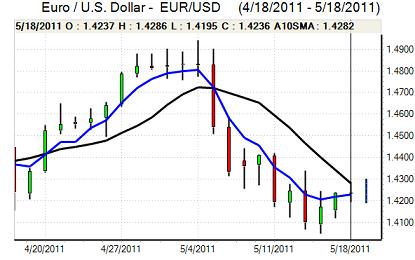

The Euro pushed to a high just above 1.4280 against the dollar in early Europe on Wednesday before drifting weaker into the US open as technical resistance levels remained tough to break down.

There was further unease surrounding the Greek debt situation following reports the previous day that some form of soft restructuring would eventually be required. There were fresh warnings over the threat posed by any debt restructuring with ECB member Bini-Smaghi, for example, warning that such a move could devastate the Greek banking sector. There were also wider fears surrounding the European banking sector and there is little chance of early relief as EU governments will not be able to address the situation until the IMF report on Greece is prepared which appears unlikely until the second week of June.

There were no major US economic data releases during the day and there was further speculation that the Federal Reserve would keep interest rates at a very low level.

Minutes from April’s FOMC meeting reported that there was an intense discussion surrounding exit strategies from the Fed’s quantitative easing programme. There was agreement that the first step should be to let mortgage-backed securities mature without re-investing the proceeds and a similar course would then be taken with Treasuries to gradually shrink the Fed’s balance sheet. There were disagreements over the timing of any potential tightening.

There was a modest rise in US Treasury yields following the data and once the Euro was unable to trigger stop-loss dollar selling towards 1.43, the currency retreated back to the 1.4230 area late in the US session before consolidating near 1.4250.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on retreats to just below 81 against the yen during Wednesday and pushed back to the 81.35 area later in the US session. There was further speculation over merger-related flows out of Japan which tended to undermine the yen.

There were no US economic releases to guide the markets while the FOMC minute did provide some dollar support as yield spreads over the yen improved and the US currency tested resistance above the 81.50 level with a high just above 81.70.

Overall confidence in the Japanese economy remained weak with expectations that a further contraction in the economy for the first quarter would force the Bank of Japan to maintain a highly expansionary monetary policy.

Sterling

Sterling drifted weaker ahead of the UK economic data on Wednesday with some market talk that the latest labour-market release would be weaker than expected. In the event, there was a larger than expected increase in the jobless claimant count of over 12,000 for April, although the ILO unemployment rate actually declined. The data overall maintained unease over the level of demand within the economy.

The Bank of England minutes recorded a further 6-3 vote in favour of unchanged interest rates at the May meeting. Sentence continued to his campaign for a 0.5% increase with Weale and Dale also calling for rates to be increased by 0.25%. There were concerns over the inflation developments, but there were also fears that any early increase in interest rates would risk putting fresh downward pressure on consumer spending.

The two members favouring a 0.25% increase also considered the case finely balanced and the generally dovish tone on the economy put Sterling under renewed selling pressure with a decline to lows near 1.61 against the dollar before a recovery back to the 1.6150 area as the Euro held above 0.88.

Swiss franc

The dollar found it difficult to make any headway against the franc in Europe on Wednesday and retreated to lows just below 0.8790, although ranges were generally narrow. The Euro was unable to make any significant headway against the Swiss currency during the session as it remained dogged by fears surrounding the Greek debt situation and wider sovereign-debt risk.

In this environment, the Swiss currency was able to resist significant selling pressure even when there was an improvement in risk appetite as European equity markets gained some ground.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar hit resistance close to 1.0660 against the dollar during Wednesday and dipped to lows below 1.06, although selling pressure was contained.

There was some negative reaction to Moody’s credit-rating downgrade of the major Australian banks, especially as it reinforced a sense of unease surrounding the domestic economy with a particular focus on the housing sector.

There were no major stresses surrounding risk appetite during the day which lessened selling pressure on the currency and it consolidated above 1.06.