The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Tuesday, May 04, 2010

Hours of daily research consolidated for you

Monday held Serve, Tumultuous Tuesday on Tap?

Monday continued the patterns of positive market action and extended the tendency of first Mondays to be really strong as investment fund money pours into the various vehicles for redeployment. The Dow was up 1.3%, the NASDAQ +1.53% and the S&P500 gained 1.31%. Volume was a little thin so this enthusiasm for higher share prices was not definitive.

- In addition to the Monday memo which most seemed to have received for the last 6 months or so, there was a number of data releases that fueled some optimism.

- European manufacturing was up to 57.6 from 56.6

- Australian Manufacturing soared to 59.8 from 50.5…big percentage

- US personal incomes rose .3% in March

- Consumer spending rose .6% in March as well-the

American Way?

- The ISM manufacturing index grew from 59.6 to 60.4

- March construction rose to 847.3 Billion, up .2% from February and a whopping 12.3% over March, 2009: which was the bottom of the building barrel. This is, of course, an annualized number.

IBD has some interesting data points this morning:

- Of the 50 time saver stocks up…97 or better ratings, 15 NHs

- The New Highs of this group had been in the 40s

- Dip buyers coming in after sell-offs?

- The A accumulation rated stocks fell 159 stocks to 557

- The Bs dropped 221 to 2312..during a big upside day.

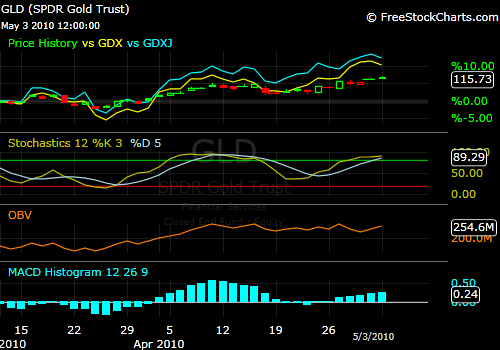

- Gold dropped from the #1 index to #6 in one day!

- Metal Ores:Gold/silver dropped from group 56 to 124

- Gold stocks went down while gold went up

- Gold went up and the dollar went up

- Stocks went up and the dollar went up and gold went up

- Changing pattern?

Money is all over the map and flowing in and out of markets with increasing rapidity. Yet the volatility indexes remain passive but picking up in intensity-compare the last few days with the charts that follow.

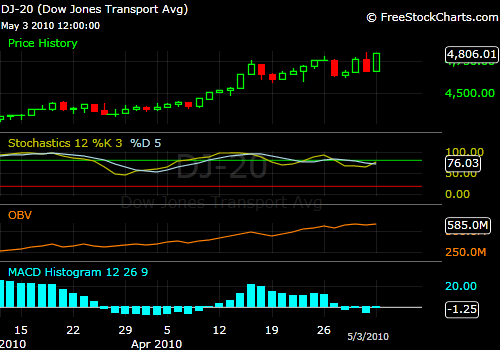

The Transports were amazing…most were up 2-3% and all 15 were positive on the day. Oil is $85 a barrel so that’s not it. An airline merger in the works…note the last few candles.

The NASDAQ…Apple is now about 18% of this index because of its’ huge market cap. Word is there is an anti-trust issue brewing coming out of the public demeaning of Adobe by Steve Jobs.

Could be interesting today.

And gold relative to gold stocks over the last few months. Gold represented by the GLD etf and GDX and GDXJ for the miners and juniors. This trend has been pretty good for the stocks in the space.

Asia had a rough night, Europe is down sharply and US futures are negative. Gold is up $3.40.

The strikes in Greece..2 more days…tells you how hard this is going to be to resolve. People just don’t believe they cannot go on with business as usual when they see the staggering bonuses paid to the minority whom the public see as having caused the problem. Where there’s smoke, there’s fire.

JohnR

Goldensurveyor.com