We had a clear signal to stay cautiously bearishonFriday.

We had a clear signal to stay cautiously bearishonFriday.

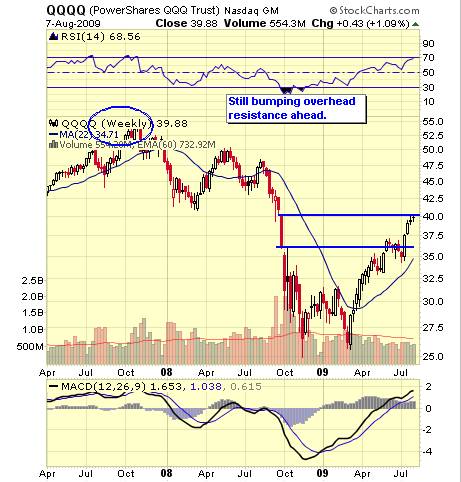

Despite the jobs rally, I had said in the morning post: “We’ll be paying special attention to the Russell, which tested the 33% line (off the top)at 574 on Tuesday. We would consider a breakout over that level to be an extremely bullish sign for our indexes. Our tip-off to get bearish at yesterday’s open was the failure of the QQQQs to break 40 so that will be our bull/bear signal for the day.” Despite the bullish-looking performance by the Dow and especially the Transports, who flew up 4% to lead the markets – the failure of the Russell to make a major breakout and the failure of the Qs to make a critical breakout at 40 (Nas 2,000) left us a bit less than bullish over the weekend.

It will remain all about 574 and 40 this week (see David Fry chart)as our other levels (Dow 9,297, S&P 1,000,NYSE 6,438, Russell 562 and SOX 308) all seem to be well and truly broken. 2,017 is the proper mark on the Nasdaq so failing 2,000 is extra bad with a side of worry. Still, as I also said Friday: “Not breaking our levels on this tremendously good jobs news would be a huge disappointment but it’s holding them that’s key.” The dollar is gatheringstrength this morning, also on the jobs news, andthat’sbeen very bullish for Asia (who export to us) this morning so keep that in mind as it does put some downward pressure on the US markets, which would make a breakout today even more impressive.

In general, we took the advice of Yukio Takahashi of Mizuho securities who said: “The smart move is to take profits now.” Our $100K Portfolio was up $12,291 in cash and $6,690 in unrealized gains so our changes were protective, looking to cap big gains made on C and LYG by selling protective calls. Having cash on the side is good as it lets us speculate a little. Not all our speculationis to thedownside, although we didtake short plays with SRS Sept $10 calls, DIA Dec $95 puts and QID Sept $24 calls into Friday’s rally, we also ran another Long Shot list for Members over the weekend as well as 5 very detailed Biotech long plays and a Pharma cover thanks to Pharmboy’s Phavorite Phings, which is a must read for Members who missed it.

In general, we took the advice of Yukio Takahashi of Mizuho securities who said: “The smart move is to take profits now.” Our $100K Portfolio was up $12,291 in cash and $6,690 in unrealized gains so our changes were protective, looking to cap big gains made on C and LYG by selling protective calls. Having cash on the side is good as it lets us speculate a little. Not all our speculationis to thedownside, although we didtake short plays with SRS Sept $10 calls, DIA Dec $95 puts and QID Sept $24 calls into Friday’s rally, we also ran another Long Shot list for Members over the weekend as well as 5 very detailed Biotech long plays and a Pharma cover thanks to Pharmboy’s Phavorite Phings, which is a must read for Members who missed it.