Another day another $453M!

Another day another $453M!

That’s right there are still 335,695 open 1,000-barrel contracts on the NYMEX with just 2 weeks left to dump them and the pump crew was foolish enough to run oil back to our $100.60 target, where we were able to jump back in and short it in last night’s Member Chat (as the Gekko said: “Money never sleeps!”). This morning we took a stop at $99.25 and now we are patiently waiting for them to pretend they want to pay over $100 for oil again so we can short it again – isn’t this fun?

We don’t get a lot of trades where the manipulation is so blatant that I can (and have for the last 2 weeks) publicly call trade ideas that thousands of people can participate in but, in this case, each single oil contract made $1,350 on that move – in just 12 hours – there’s plenty of money to be made for all on these and, of course, we’re doing it to PUNISH the speculators so we need as many participants as possible to maximize their pain (and keep in mind we use very tight stops to minimize ours!).

Regular options players will also do well with our last trade of Friday, which was the USO June $40 puts (yet again) at $1.15, which should do well this morning with USO down about .70 with oil on the $99 line. Heck, even as a stock trade that’s 2% shorting USO in 90 trading minutes – not a bad ROI even for boring old stocks…

Regular options players will also do well with our last trade of Friday, which was the USO June $40 puts (yet again) at $1.15, which should do well this morning with USO down about .70 with oil on the $99 line. Heck, even as a stock trade that’s 2% shorting USO in 90 trading minutes – not a bad ROI even for boring old stocks…

As we expected $98.50 has been hanging pretty tough as support for West Texas Crude but I don’t think it will stand up to a rising Dollar so we’ll watch that for clues of a proper breakdown and a ride down to our next set of oil marks.

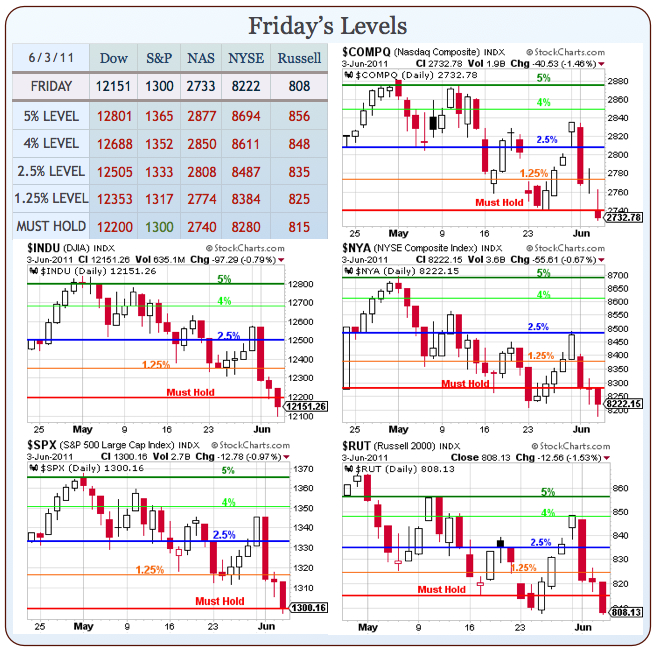

Speaking of lines – look how beautifully our levels are lining up with only the S&P still above (but right on) our long-predicted “must hold” level. I went over our expectations for the next two weeks in this morning’s Member Alert so I won’t get into it again here but if we follow the script into expirations as well as we’ve followed it during May – we’ll be getting this summer off to a great start!

IN PROGRESS