NOW Greece is going to matter?

Just when we were planning to get bullish, the Futures are off half a point as concerns about Greece, of all things, come back to the forefront as pretty much the entire country is poised to strike this evening on the expected news that even stricter austerity measures will be jammed down the throats of a Nation that is already suffering from 20% unemployment.

Greece’s debt is “only” 159.1% of their GDP – that’s just lunch money to Japan and you don’t see anyone worrying about them, do you? Portugal’s debt to GDP ratio has gone from 106.5% to 110.1% last quarter but the year before it was at 91.2% so let’s look on the bright side and say their debt acceleration is slowing. Ireland also “only” rose to 104.9% (not 105%!) from 102.3% and that’s much slower than the run from the previous year’s 88.4%, which is about where the UK is now (85.2%) and that’s below the EU average of 87.4% so bravo Britain and all that!

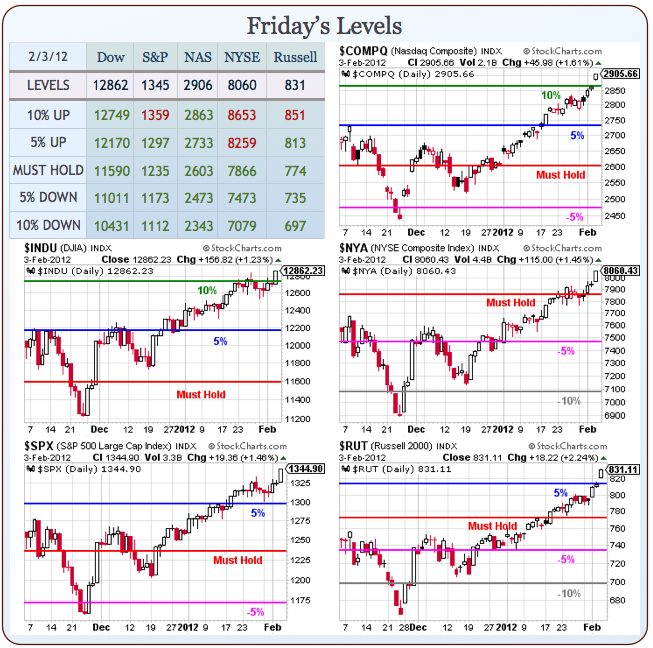

As I said to Members in this morning’s Chat, I am resolved to only look on bright side of the news until we fail to hold our technical breakouts at Dow 12,749, S&P 1,333, Nasdaq 2,863, NYSE 7,866 or Russell 815 – as long as those hold up, we are beyond the reach of news gravity and should all do our best to ignore all that silliness going on on Earth and just concentrate on which stocks don’t have p/e’s of 100 yet so we can keep buying along with the crowd.

Looking at our Big Chart, we certainly have an impressive-looking breakout and far be it for me to point out it came at the expense of a weak Dollar so, unless you were 100% in stocks and gained along with the S&P faster than the Dollar fell, you probably had a net loss of wealth during this “rally” as the declining Dollar decimated the value of everything else you worked to build over your entire life but, hey – look at that S&P go!

Looking at our Big Chart, we certainly have an impressive-looking breakout and far be it for me to point out it came at the expense of a weak Dollar so, unless you were 100% in stocks and gained along with the S&P faster than the Dollar fell, you probably had a net loss of wealth during this “rally” as the declining Dollar decimated the value of everything else you worked to build over your entire life but, hey – look at that S&P go!

Jobs are also on the march, unless you listen to Rush Limbaugh and the rest of the Conservative Media’s spin on the subject. The last thing the Right want’s to see is Americans going back to work – especially during…