Does this look good to you?

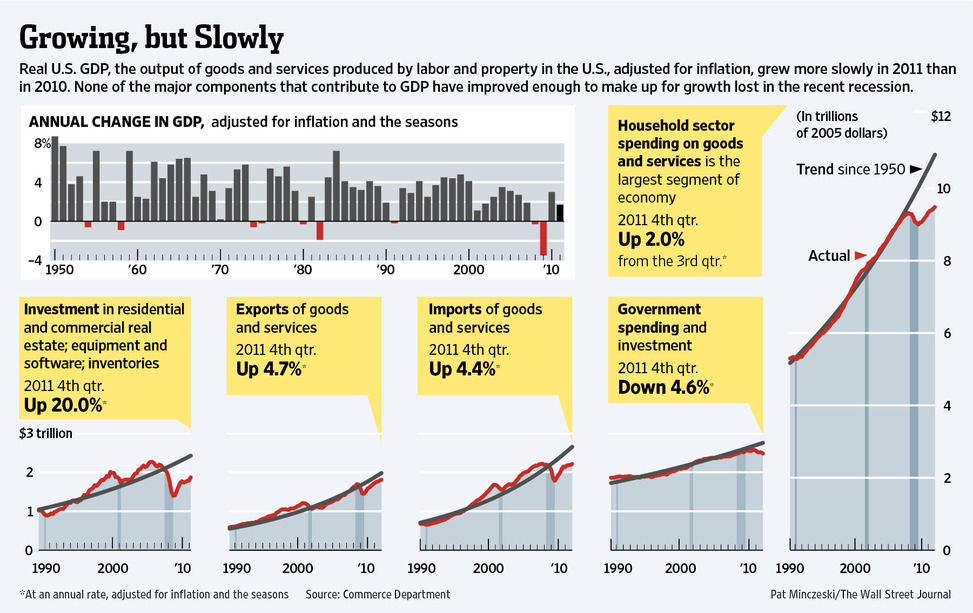

Here’s that GDP analysts found so exciting on Friday and this very chart is from the WSJ article that spins it: “US Economy Picks Up Steam.” I would especially like to draw your attention to the big graph on the right, which shows Household Spending, which is 70% of our economy, only now just getting back to our 2007 highs while Government Spending (20% of our GDP) begins to tail off and Real Estate and Business Spending are in an anemic at best recovery. And this is AMERICA – We’re supposed to be LEADING the Global recovery.

By the way, huge Greek nonsense in Europe this morning – big market mover, blah, blah, blah – if you want to delve into that, we already wrote about it in great detail in Stock World Weekly, in our Week Ahead section (pages 10-14), so no need to go over it again. In fact, a lot of what is being considered “breaking news” today by CNBC and Bloomberg was already fully covered by us over the weekend.

By the way, huge Greek nonsense in Europe this morning – big market mover, blah, blah, blah – if you want to delve into that, we already wrote about it in great detail in Stock World Weekly, in our Week Ahead section (pages 10-14), so no need to go over it again. In fact, a lot of what is being considered “breaking news” today by CNBC and Bloomberg was already fully covered by us over the weekend.

Instead I think it’s a good time to reflect on the good old US markets and whether or not they are worth buying back at our lofty pre-crash levels. Wall Street Rant does a nice job of summarizing the McKinsey Report on the Global Equity Gap – something our US-based traders have a difficult time absorbing since we are, by far, the most market-centric nation and, much like the Spanish Inquisitors who locked up Galileo, they don’t like to hear that the Universe doesn’t revolve around them…

US investors, in fact, do own 41.7% of all the World’s equities and Western Europeans own 28.9% – that’s 70.6%, leaving just 29.4% for the other 85% of the World’s population to care about. Now, you may think that’s somehow proportional to our share of the assets but it’s not – in fact, the US is unique in that we actually own far more equities than we have assets – by 42%! So, even in stock interest – the US is running a tremendous net deficit with the rest of the World.

Japan’s asset to equity ratio resembles their usual balance of trade, they buy a lot less than they sell. China holds 10% of the World’s assets (1/3 of what we have) but…