Here we go again!

Here we go again!

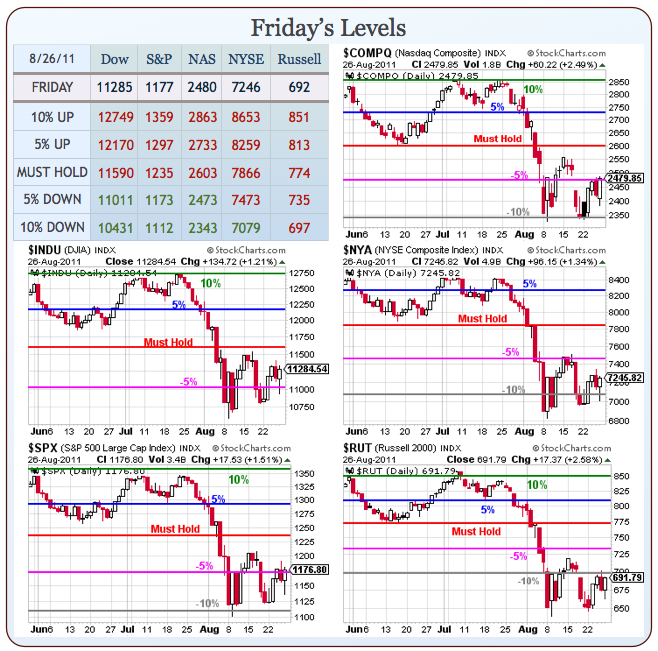

We got ALL the good news we’re likely to get for the month and the next Fed Meeting is not until Sept 20th and the proposed jobs-creating “infrastructure bank” still far from reality – it’s now up to the Bulls to show us the money and move our indices back over those Must Hold lines (which, of course, MUST hold) and back to at least the 5% marks over the next 2 weeks. Let’s not forget that those 5% lines are STILL 10% below the average analyst forecast for the year’s close (1,350 on the S&P).

I said to Members this weekend, as I laid out a new September’s Dozen list, that we still need to confirm that this 4-8% recovery zone we are in is more than just the bounce we EXPECTED to get after a 20% drop in our indexes.

If you think of the movement as a bouncing ball (or dead cat!), then you can clearly see that NOT making it back over the middle of that W formation quickly would only serve to indicate that our pattern is still trending down with bounces that are getting weaker and – if that is all we can muster after Uncle Ben begins to warm up the FREE MONEY machine – then we are in DEEP TROUBLE!

But I have faith! Just as I had faith last year when I put up our aggressive September’s Dozen list under very similar conditions and they were wildly successful so this year, perhaps it’s a bit of wishful thinking, but we’re jumping the gun and locking in a few aggressive plays before September even begins. We are not SURE that we’re not too early so we remain cautious but we’d hate to miss a party so we can put a little of our sideline cash to work but with tight stops in case the market decides to be less aggressive than we are.

But I have faith! Just as I had faith last year when I put up our aggressive September’s Dozen list under very similar conditions and they were wildly successful so this year, perhaps it’s a bit of wishful thinking, but we’re jumping the gun and locking in a few aggressive plays before September even begins. We are not SURE that we’re not too early so we remain cautious but we’d hate to miss a party so we can put a little of our sideline cash to work but with tight stops in case the market decides to be less aggressive than we are.

Until now, we have been concentrating on very short-term directional trade ideas with quick in and out profits and very long-term, well-hedged buy/write trade ideas, where we have a solid, built-in, 20% downside protection (see “How to Buy a Stock for a 15-20% Discount“) based on my premise that the “worst case” for the Global GDP really isn’t that bad.

IN PROGRESS