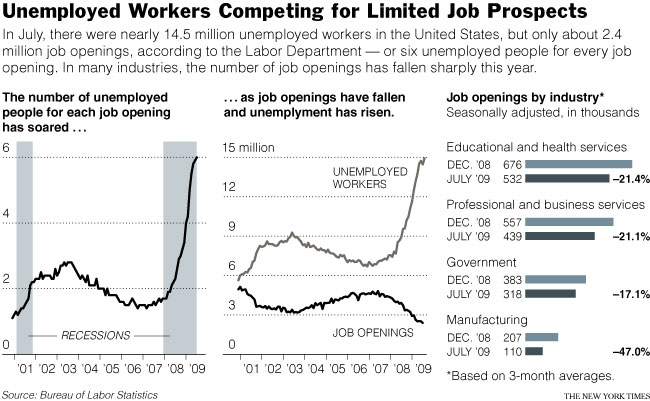

The number of unemployed people per job opening has climbed to 6:

Six is a lot, as you can see from the above chart. 6 means that if you get a job, 5 people absolutely will NOT be able to get a job because you just took the last one. Notice Job Openings are still falling and people without jobs are still rising – this is not a good combination, despite how great you hear things are getting on TV. In the first 6 months of this year, there are half as many manufacturing jobs available, 17% less Government Jobs, 21% less Professional Jobs and 21% less Educational Jobs.

Call me old-fashioned but I still think you need people to work in order to have a strong economy. If we have 10% unemployment (the “official” number) and only 1 in 6 people COULD get jobs if they filled every single available opening tomorrow. That still leaves us with 8.5% unemployment. We are miles and miles away from creating jobs and that is very scary.

As I predicted in the Weekend Wrap-Up, Merkel won her election in Germany and the new “Pro-Business” coalition is making investors happy but Germany has some silly rule about balancing their budget so it will be a long time before you see the massive tax cuts that investors are salivating over. Also, one would think people would sober up and short the Euro if their plan is to start running the German printing presses in a US-styled Spendocracy but no action in the currency markets so far. I wrote some extensive commentary on the German situation in Member Chat so I won’t get into it again here.

This weekend, I also posed the questions “Are Fundamentals Making a Comeback,” or are we just resting before the next big push to 10,000? We’ll be keeping a very close eye on our 5% rule levels next week, especially the retrace levels from the 20% run-ups since early July:

| Dow | S&P | Nasdaq | NYSE | Russell | Trans | HSI | Nikkei | FTSE | DAX | |

| Fri Close | 9,665 | 1,044 | 2,091 | 6,824 | 599 | 1,932 | 21,024 | 10,266 | 5,082 | 5,581 |

| 2.5% Up | 9,950 | 1,077 | 2,160 | 7,034 | 617 | 2,001 | 21,577 | 10,808 | 5,206 | 5,745 |

| Prev Close | 9,707 | 1,051 | 2,108 | 6,862 | 602 | 1,952 | 21,051 | 10,544 | 5,079 | 5,605 |

| 2.5% Down | 9,465 | 1,025 | 2,055 | 6,691 | 587 | 1,903 | 20,524 | 10,281 | 4,952 | 5,465 |

| July Base | 8,200 | 880 | 1,750 | 5,600 | 480 | 1,650 | 17,500 | 9,200 | 4,200 | 4,600 |

| 20% Up | 9,840 | 1,056 | 2,100 | 6,720 | 576 | 1,980 | 21,000 | 11,040 | 5,040 | 5,520 |

| Retrace | 9,512 | 1,020 | 2,030 | 6,496 | 556 | 1,914 | 20,300 | 10,672 | 4,872 | 5,336 |

We can see from the chart that only the Nikkei has blown it’s retrace level but they have also never hit their 20% level. All the other indexes have hit 20% up and the Hang Seng is in the most immediate danger of giving it back but the NYSE and Russell are playing it close to the bone while hitting the 2.5% line off Thursday’s close would put most of the indexes under the 20% mark so we are a small slip away from a very red chart.