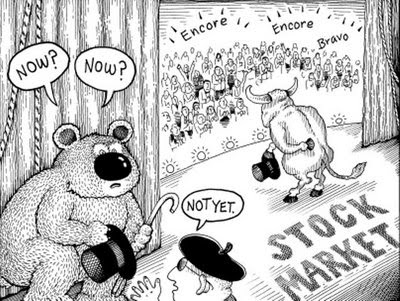

Am I too bullish?

Am I too bullish?

I know I’ve been making a bearish case last week and I know we put out our first bearish list since April this month but, in reviewing October’s Overbought Eight for Members this weekend we reviewed the week’s picks and I realized that, despite all my griping, we had ended up with 21 bullish trade ideas vs. just 10 bearish ones AND, not only that, but half the bearish bets were quickie trades where we played the drops, like Friday’s DIA and QQQQ puts from the morning Alert that didn’t even last an hour (but made 300% and 200% respectively, so worthwhile, nonetheless).

That’s not very bearish. I had said to Members in last Monday’s Morning Alert: “The critical test levels above 7.5% are Dow 10,950, S&P 1,160, Nasdaq 2,400, NYSE 7,450 and Russell 690- all green for day 2 and that does put us technically bullish if we hold it, even though it’s a BS, low-volume day.” and we did hold those lines on Tuesday’s dips to we cashed our first set of shorts and ended up flipping more bullish for the ride up to the 10% lines (Dow 11,220, S&P 1,177, Nas 2,420, NYSE 7,500 and Russell 700), despite out misgivings. When the technicals are very strong, you have to switch off the fundamental side of your brain and go with the flow.

It has been ALL about the dollar and, as we mentioned in this week’s Stock World Weekly, Trichet gave us the word we expected on Tuesday that knocked the dollar down to new lows against the Euro, Pound and Yen, with the dollar index bottoming out at 76 which should, in theory be strong technical support.

It has been ALL about the dollar and, as we mentioned in this week’s Stock World Weekly, Trichet gave us the word we expected on Tuesday that knocked the dollar down to new lows against the Euro, Pound and Yen, with the dollar index bottoming out at 76 which should, in theory be strong technical support.

So, we have strong technical AND fundamental reasons to expect a dollar bounce and we KNOW that a dollar bounce will knock down commodities and we KNOW that a pullback in commodities will knock down the indexes as the energy and metals sector lead us lower. If we KNOW all this, then we MUST be too bullish, right?

Of course we reached that conclusion on Thursday and this is just a recap as 6 of those 10 bearish trade ideas from last week were from Thursday and Friday with EDZ, QID, QQQQ, SQQQ, QID (again), and DIA all picked short as we tested those 10% lines. We like to go with the ultras as hedges because we get more…