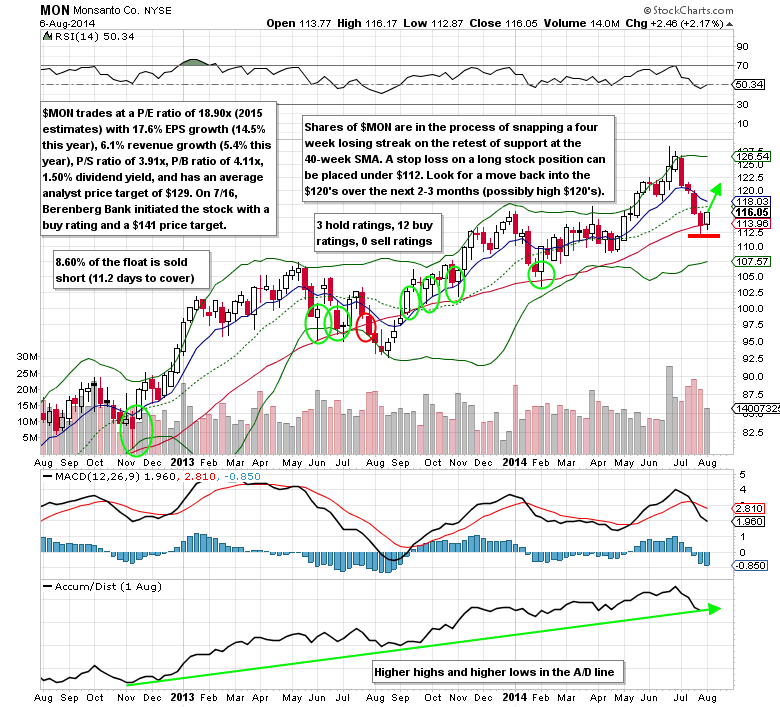

Shares of the $60 billion agricultural products provider, Monsanto (MON), are down 0.68% year to date after being up as much as 11.35% in June. This recent correction that brought down not just Monsanto, but the likes of Mosaic (MOS), Potash (POT), and commodities such as corn, soybean, and wheat, is setting up for a low risk buying opportunity on a retest of the 40-week simple moving average (SMA) [see the chart below]. The 40-week SMA (also the 200-day SMA) has been an entry point for longer-term holders of the stock since November of 2012.

Crunching The Numbers

Despite trading at a P/E ratio of 18.90x (2015 estimates), Monsanto will still grow EPS by 17.6% next year making it a more attractive investment. Revenue growth will accelerate to 6.1% from 5.4% this year. On June 25, Monsanto reported Q3 EPS of $1.62 vs. the $1.55 estimate and revenue of $4.25B vs. the $4.37B estimate. They raised their FY14 EPS outlook to $5.12-$5.22 vs. the prior estimate of $5.02-$5.22. After the bell on August 5, they raised their dividend 14% to $0.49 from $0.43 (1.69% annual yield).

The average analyst price target is currently $129 (3 hold ratings, 12 buy ratings, 0 sell ratings). Three recent analysts changes include: Berenberg Bank initiated the stock with a buy rating and a $141 price target, (7/16) Zacks maintained a neutral rating with a $127 price target (7/14), and Citigroup maintained a buy rating with a $146 price target (6/27).

Monsanto Options Trade Idea

Buy the Sep $115 call for $3.50 or better

Stop loss-$1.50

First upside target- $7.00

Second upside target- $10.00

Disclosure: I’m long the Sep $115 call for $3.38 each.

Read More

Mitchell’s article: The Importance Of The S&P 500 New Highs New Lows Percent Indicator (SPXHLP)