Just a reminder, these charts are posted as examples of the trades on the nightly COT Signals email. These trades will help illustrate the mechanics that go into creating the nightly email.

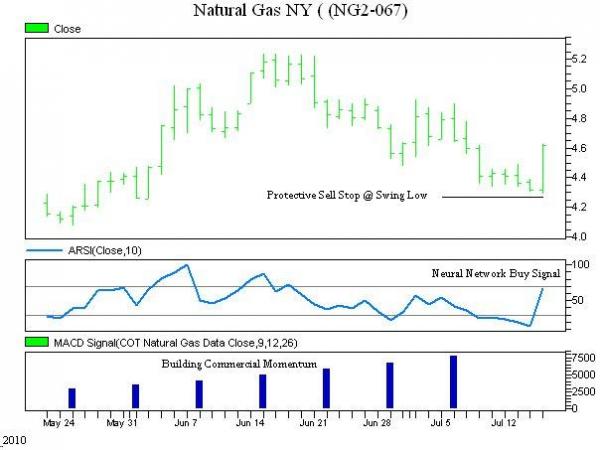

August Natural Gas has sold off over the last month, despite clear buying momentum from commercial traders. Perhaps this is because the market is seasonally weakest from the first week of June through the second week of July.

In spite of the market’s recent sell off, it is still well above the April lows and yesterday’s low coincided with considerable support in the 4.300 area.

Finally, after a week’s worth of narrowing ranges and declining volatility, the market tipped its technical hand in favor of the bulls in two ways. First, the market put in a one bar reversal to the upside. It made a new 30 day low in the morning and spent the rest of the day rallying. This is a classic sign of exhaustion. The market has run out of fresh sellers. Secondly, this action took place with volume confirmation. Yesterday was the biggest volume day since September of ’09. This suggests massive short covering as well as the initiation of new long positions entering the market.

Based on these factors, we are buying natural gas and placing a protective sell stop at the swing low of 4.288.

Please call with any questions.

Andy Waldock

866-990-0777