Just a reminder, these charts are posted as examples of the trades on the nightly COT Signals email. These trades will help illustrate the mechanics that go into creating the nightly email.

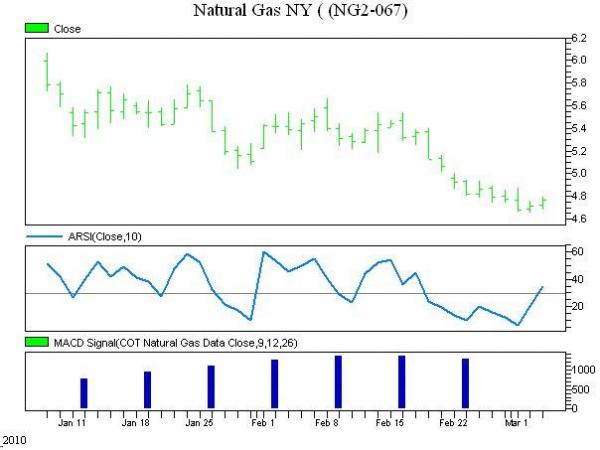

April Natural gas is testing its December 3rd low. However, as we’ve approached these levels, we’ve seen a considerable build up in Commercial Long positions.

Given yesterday’s early sign of a bounce, our indicators suggest that there is an opportunity to buy April Natural Gas while using a very close protective stop.

Tuesday’s swing low of 4.655 is where we are placing our protective stop. At the market’s current price of 4.740 that leaves a risk of $850 per contract. Given the LARGE size of the Natural Gas contract, this is a rare opportunity to employ the full effects of leveraged futures trading through the use of protective stop orders.

Please call with any questions.

Andy Waldock

866-990-0777