Gold and natural gas are two commodities that have been making headlines recently—although they have been moving in different directions for different reasons. I think short-term corrective moves in both markets may be in order, and may have already begun.

Gold

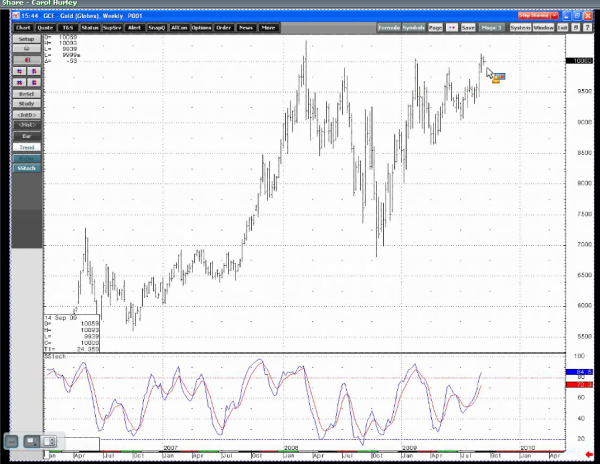

Gold reached an 18-month high on September 11, 2009, with December COMEX futures hitting $1,006.40 an ounce. Gold has now risen four straight weeks. If you are a gold bug and are not yet in the market, I wouldn’t fret about missing the move too much. I think gold should face a slight correction that will give you an opportunity to buy at lower prices. The March 2008 record high at $1,033.90 has faced challenges, but I think that high should hold for now as strong resistance. While gold has been quite strong, it’s important to be aware of some potential pitfalls in the near-term.

According to an article in Bloomberg, gold held in the SPDR Gold Trust, the largest gold-backed ETF, reached a record 1,134 tons on June 1 and was at 1,077.6 tons as of Sept. 11, overtaking Switzerland as the world’s sixth largest holder of gold. Assets in ETF Securities Ltd.’s exchange-traded products climbed to a record 8.22 million ounces (255.6 tons) on Sept. 11. This might sound bullish on the surface, but a sudden break in the gold market might send these investors rushing for the exits. It’s also not out of the question that the IMF will sell some of its gold to central banks because of the troubles in Europe, as a way to prop up their coffers.

U.S. dollar weakness has also been supporting gold’s gains, but a rebound could also trigger gold market profit-taking. The ICE U.S. Dollar Index futures, which tracks the dollar against a basket of six global currencies, is approaching support at 76.00.

Jewelry demand has been slack this year, so gold’s growth has been driven by investment demand. At least for the short-term, I recommend selling this market anywhere above $1,000, with a stop at $1,017. I think we will get a correction down to $950. If you are a gold bull, I think you will get a chance to repurchase around $950, and put a stop at $934.

Even though I’m a long-term bull on gold and commodities in general, I think in the short-term, traders should watch for a corrective move lower. Current levels are a logical spot for profit-taking from a technical standpoint. On the weekly chart, I see the market approaching a double-top.

Natural Gas

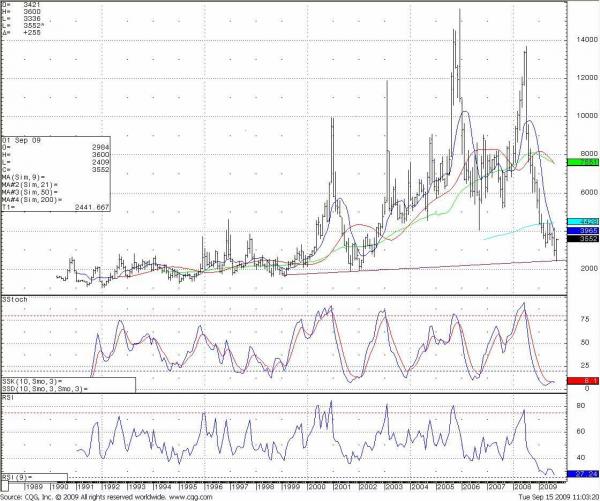

Yes, we have boatloads of natural gas and the supply glut has driven prices down sharply this year. The front-month contract slid to about $2.50 MMBtu, hitting 7 1/2-year lows, and everyone had given up on natural gas. But I think that’s the time you start getting interested. NYMEX natural gas futures market bounced off a trendline and saw a sharp move higher on Monday, September 14, closing up more than 11 percent.

U.S. Natural Gas Fund (UNG), the world’s largest natural gas ETF, announced it will begin selling new shares under “limited circumstances” beginning September 28. That means they will likely have to come back into to the futures market as this fund invests in both NYMEX gas contracts as well as swaps, driving up prices. I would recommend buying October futures around $3, and put a stop at $2.76.

The October natural gas futures are pretty cheap at around $3.297 right now, but the market is pricing in higher prices out in time, as the December futures contract is trading at just a little under $5. For the front-month contract, I think $4 is a reasonable target. Don’t underestimate a short squeeze. We might even be able to get to $4.50. Winter is approaching and this UNG announcement could send the shorts scrambling.

Please feel free to contact me with any questions you might have about these or other markets, and to develop an appropriate trading strategy for current market conditions.

Carol Hurley is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. She can be reached at 866-790-4371 or via email at churley@lind-waldock.com.

Futures trading involves substantial risk of loss and is not suitable for all investors.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

© 2009 MF Global Ltd. All Rights Reserved.