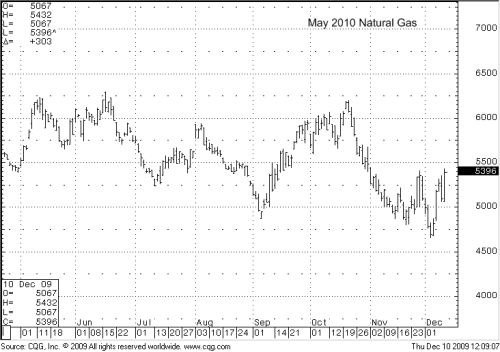

While dollar weakness has helped drive the majority of commodities markets higher recently, natural gas did not participate in this rally. In fact, natural gas prices have continued to move counter to the index as a whole, receding by more than 15% since a short lived spike back in October.

There is good reason for this. While longer term prospects for the fuel still appear bright, short term supply overages have kept a steady pressure on natural gas and mitigated much of the seasonal strength often associated with the fuel at this time of year. Energy traders chose to buy crude oil on dollar weakness and then sell natural gas (the fundamentally weaker market) as a hedge. This added an additional layer of pressure onto natural gas prices.

When the dollar began to strengthen in early December, Natural Gas again moved counter to most of the commodities complex, rallying while most markets moved lower – a result of the unwinding of these spreads combined with a timely winter storm moving through the northern US.

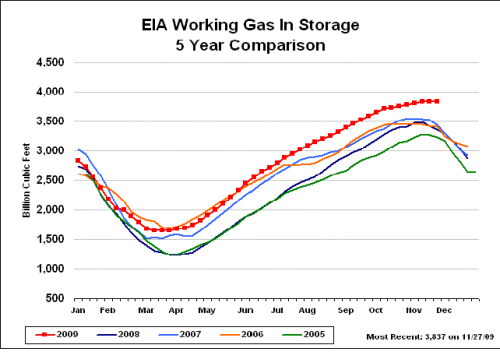

Yet, the most influential fundamental for natural gas remains it’s burdensome supply situation. Recession related demand declines allowed stocks to accumulate through summer and fall of 2009. This has resulted in current stocks nearly 13% above 5 year averages.

Despite the supply glut, natural gas may yet be saved by the weather. December typically results in a high water mark for Gas inventories as “real” winter begins and seasonal usage materializes in earnest. This tends to draw down inventories into March, when stockpiles begin to build again.

Despite the supply glut, natural gas may yet be saved by the weather. December typically results in a high water mark for Gas inventories as “real” winter begins and seasonal usage materializes in earnest. This tends to draw down inventories into March, when stockpiles begin to build again.

This seasonal inventory drawdown often results in firmer natural gas prices. However, before you sell the farm to buy natural gas, consider that this year’s beginning inventories could go a long way towards tempering gains.

This balancing act of fundamentals makes natural gas an excellent candidate for strangles (selling deep out of the money puts and deep out of the money calls). The objective of this strategy would be for natural gas to remain in a predefined range so as to make money on both sides of the trade. If selling close to 50% out of the money on both sides, you leave yourself a fairly wide range for profit. We advise waiting for some weather related volatility to sell this strangle as it will allow you to sell more distant strikes.

We’ll be working closely with both existing and new clients in positioning this trade during December.

To learn more about selling options in the commodities markets, feel free to visit us on the web at www.OptionSellers.com. A complimentary option selling information pack is available for qualified investors.