By FXEmpire.com

Natural Gas Fundamental Analysis April 11, 2012, Forecast

Analysis and Recommendations:

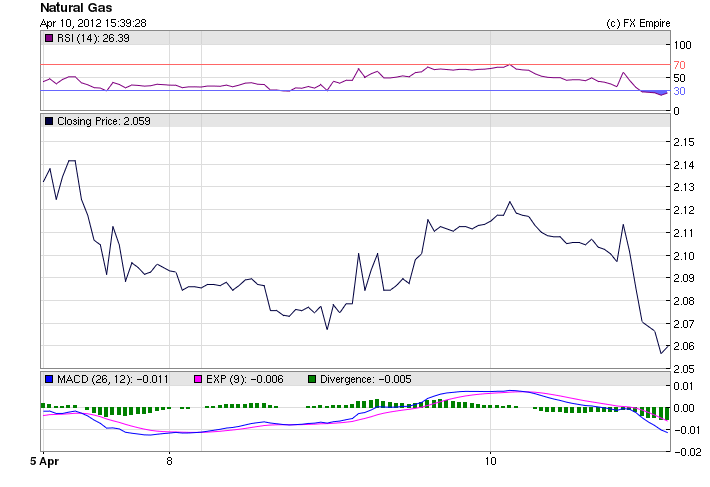

Natural Gas continued to fall again today, selling at 2.046

Natural gas prices have plunged almost 21% since the beginning of March and are down nearly 31% since the start of 2012 as market sentiment has been dominated by concerns over elevated U.S. storage levels and mild winter weather that has limited demand for the fuel.

Today, Marathon Oil Corporation announced that it has entered into a definitive agreement with Hilcorp Alaska LLC, under which Hilcorp will purchase substantially all of Marathon Oil’s Alaska assets.

The companies expect to close the transaction, subject to completion of the necessary Government and regulatory approvals, by this fall.

With an effective date of Jan. 1, 2012, the sale includes 17 million barrels of oil equivalent of net proved reserves across 10 fields in the Cook Inlet, as well as natural gas storage, and interests in natural gas pipeline transmission systems.

In 2011 net production averaged approximately 93 million cubic feet of natural gas per day and 112 barrels of oil per day.

Additionally, Marathon Oil had approximately 12.5 billion cubic feet of natural gas in storage at the end of 2011.

Economic Events: (GMT)

WEEKLY

-

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Originally posted here