By FXEmpire.com

Natural Gas Fundamental Analysis April 17, 2012, Forecast

Analysis and Recommendations:

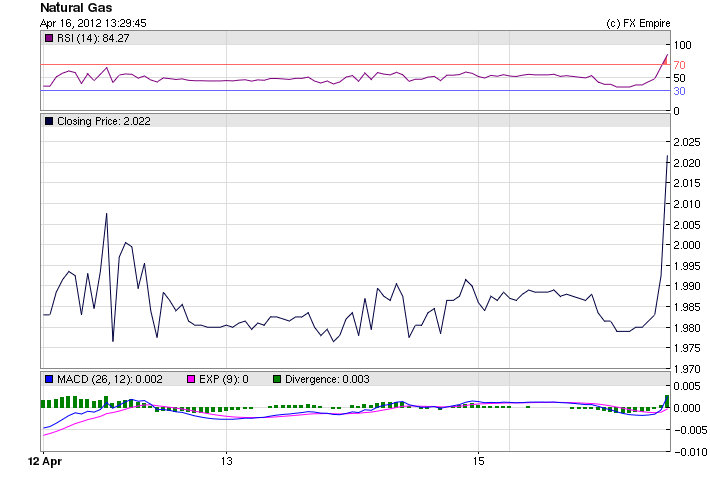

Natural Gas made a move today, moving upwards to trade at 2.002 adding 0.021.

Japanese power utilities consumed more crude oil, heavy fuel oil and liquefied natural gas last fiscal year ended March 31 as they boosted operations at thermal plants to make up for lost nuclear capacity, the Federation of Electric Power Companies announced today, global demand is increasing steadily for natural gas and President Obama is now leading the charge to develop LNG as an export for the US.

For more than 20 years, Chesapeake Energy has been a leader in driving up the supply of natural gas. Now it’s trying to spark the demand side of the equation — a reach for any player.

Chesapeake has pledged to invest $1 billion to increase the use of natural gas in transportation. Efforts range from creating a nationwide network of truck stops to developing home fueling kits that let people fill up in their garage. And partners include 3M and General Electric, two global heavyweights whose involvement signals the potential of this market.

The country is awash in cheap natural gas, thanks to the success of Chesapeake and others in developing shale gas nationwide, including in North Texas’ Barnett Shale. Chesapeake is the second-largest producer here and has a regional office in Fort Worth.

Last week, natural gas prices fell as low as $1.91 per 1,000 cubic feet, the lowest since 1999, because of the supply glut. Nationwide, production is running 5 percent ahead of last year’s pace, and after a mild winter, underground stores of natural gas are 58 percent greater than the average for the past five years.

Economic Events: (GMT)

WEEKLY

-

Heating Oil & Propane Update (October-March)

Heating Oil, Propane Residential and Wholesale Price Data

Release Schedule: Wednesday at 1:00 p.m. EST -

Weekly Coal Production

Release Schedule: Thursday by 5:00 p.m. EST -

Weekly NYMEX Coal Futures

Release Schedule: Monday by 5:00 p.m. EST -

Natural Gas Weekly Update

Release Schedule: Thursday between 2:00 and 2:30 p.m. (Eastern Time) -

Weekly Natural Gas Storage Report

Release Schedule: Thursday at 10:30 (Eastern Time) (schedule)

Originally posted here