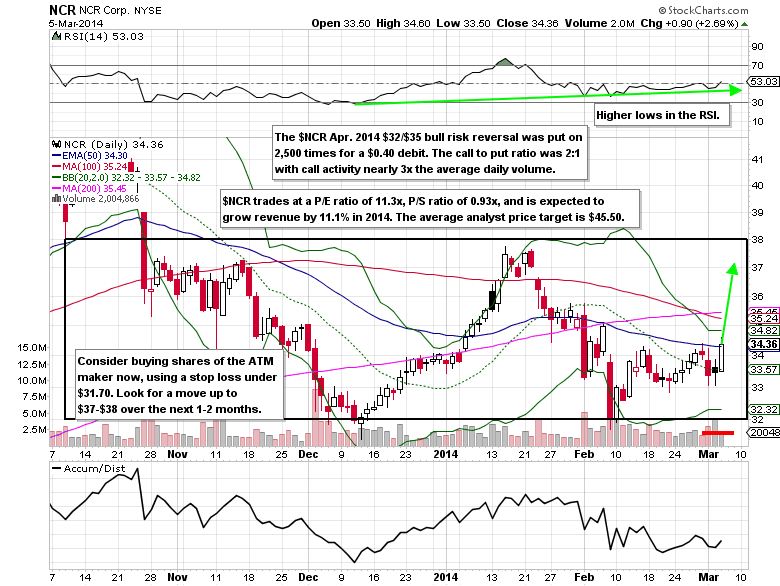

NCR (NCR), the maker of ATMs and Point of Sale (POS) hardware and software, shares are down 17.46% from the September 2013 highs. NCR trades at a P/E ratio of 11.3x, P/S ratio of 0.93x, and is expected to grow revenue by 11.1% in 2014. The average Wall Street analyst price target is $45.50.

Options Activity

On Wednesday, March 5, someone put the Apr $32/$35 bull risk reversal on 2,500 times for a $0.40 debit (bought Apr $35 calls for $1.01 and sold the Apr $32 puts for $0.61 each). He/she is looking for the stock to close above $35.40 on Apr options expiration. The call to put ratio was 2:1 with call activity nearly 3x the average daily volume.

Technical Analysis

Since September, shares of NCR have been trading in a range of $32-$38. The stock retested the $32 support level last month and is now starting to move back above the middle Bollinger Band® (20-day SMA), which sets up for a move back up to $37-$38. At current levels the reward/risk ratio is 2:1 for the NCR bulls.

NCR Options Trade Idea

Buy the Apr $35 call for $1.20 or better

Stop loss- None

1st upside target- $2.00

2nd upside target- $3.00

Disclosure: I’m long the Apr $35 calls for $1.10 each.

= = =

Mitchell’s Free Trade of the Day featuring Five Below (FIVE)