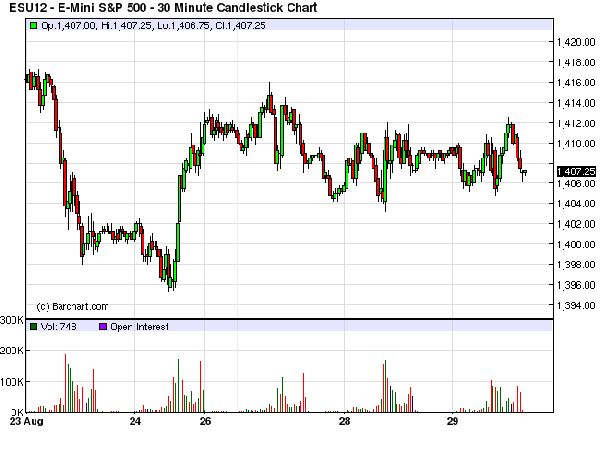

The release of the Federal Reserve’s Beige Book showed a few positive signs, but not big enough to rally the market. Economic activity “continued to expand gradually,” with modest growth in consumption and an improved housing market. The September E-Mini S & P (ESU2) seemed fairly quiet after the release, and closed yesterday at 1404.75, a 1.50 point gain from the previous session.

The dog days of summer are nearly over, but not quite yet.

WAITING ON BEN

All eyes and ears are now directed towards Jackson Hole, not for a cool break, but to see what comes from Fed Chairman Bernanke. Will he or won’t he bring on QE3?

IS QE3 PRICED IN?

With the S & P trading above 1400, I feel that many traders are saying he will. Don’t look for a confirmed QE3 to rally the market, as it appears to me as already being priced in. Any clear refusal to for any more action could bring in a significant sell off.

SUPPORT

Look for support levels to hold near 1400. After the Labor Day holiday, watch for a potential pick-up in market action as everyone returns to school and work full time.

THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES AND OPTIONS TRADING. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THE USE OF A STOP-LOSS ORDER MAY NOT NECESSARILY LIMIT YOUR LOSS TO THE INTENDED AMOUNT. CURRENT EVENTS, MARKET ANNOUNCEMENTS AND SEASONAL FACTORS ARE TYPICALLY BUILT INTO FUTURES PRICES. A MOVEMENT IN THE CASH MARKET WOULD NOT NECESSARILY MOVE IN TANDEM WITH THE RELATED FUTURES AND OPTIONS CONTRACTS.