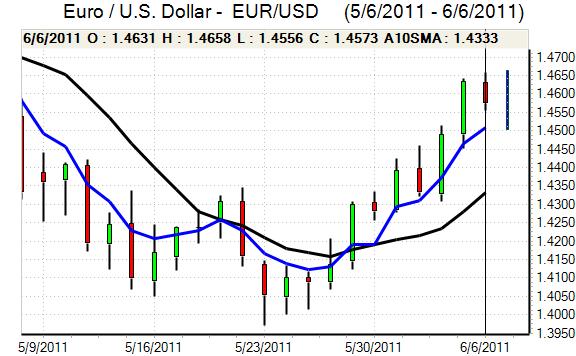

EUR/USD

The Euro pushed to a high just above 1.4650 against the dollar in European trading on Monday before hitting resistance and it retreated later in the session as the dollar gained some respite.

There was negative rhetoric surrounding the Euro from key officials during the day. Euro-group head Juncker stated that the Euro was overvalued against all major currencies which had some negative impact on the currency, especially as it was in contrast with previous comments which suggests that unease has increased. There were also hard comments from ECB President Trichet surrounding previous Greek policies. Although he also stated its willingness to accept a debt restructuring if there were no forced losses for private bondholders.

As far as the second Greek aid support is concerned, there was no report yet from the IMF-led delegation with reports suggesting that it would be released around the middle of this week. There were comments from German officials that a Greek bailout was not certain and there were further domestic wrangling surrounding austerity measures, although Chancellor Merkel maintained a more optimistic tone which helped stabilise confidence. There was a further decline in the Euro-zone Sentix business confidence index which will have some negative impact on economic sentiment.

There were no major US data releases with the dollar still sapped by fears over a weaker economy and the possibility that there would need to be further Federal Reserve quantitative easing. The Euro retreated to the 1.4550 area with expectations of a firm ECB tone later this week curbing further selling pressure. The dollar gained some support from a more defensive attitude towards risk as global growth doubts increased, but there was little enthusiasm for the currency and the Euro nudged back above 1.46 in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make significant headway during Monday and dipped to test support close to 80.0 against the Japanese currency before finding some degree of support. There were reports of aggressive Far East sovereign bids for the dollar close to 80 which helped provide support.

The dollar was still undermined by a lack of yield support following the weaker than expected US payroll data on Friday with US Treasury yields trapped near 2011 lows.

Underlying sentiment towards the Japanese economy remained weak which curbed yen buying support. There was speculation over renewed G7 intervention as the yen strengthened to near the 80 level and the Japanese Finance Ministry warned that currency markets were being watched very closely which provided some dollar support.

Sterling

Sterling hit resistance close to 1.6450 against the dollar during Monday and dipped to test support near 1.6350 in generally cautious trade. The UK currency was undermined by a limited technical dollar recovery, but there was also some independent selling pressure as the Euro challenged resistance above 0.8940.

The IMF broadly endorsed the government’s fiscal policies and the need to cut the budget deficit. It was generally cautious over the economy and warned that further quantitative easing might be required if there was a fresh downturn in the economy. Underlying sentiment towards Sterling remained weak on a lack of yield support, especially with expectations that the Bank of England would again keep interest rates on hold at this week’s MPC meeting.

The latest economic data offered no support with a 2.1% decline in the BRC retail sales index for May following a 5.2% increase the previous month.

Swiss franc

The dollar found some support below 0.8350 against the franc during Monday, but was unable to make significant headway with very little in the way of rallies. The dollar was hampered by a stronger tone on the crosses as the Euro retreated to below 1.22.

Risk appetite was generally more cautious amid fears over a slowdown in the global economy which continued to provide solid support for the Swiss currency as it remains the dominant safe-haven currency. Expectations that the ECB will signal higher interest rates at this week’s meeting should provide some degree of Euro support against the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

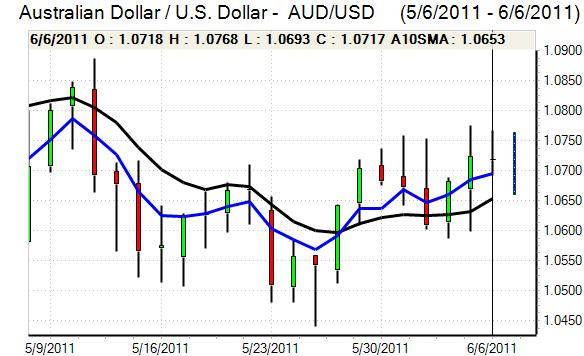

Australian dollar

The Australian dollar hit resistance above 1.0750 against the US currency on Monday and retreated towards the 1.07 area as it was hampered by a general lack of enthusiasm towards risk and unease over the global economy.

As expected, the Reserve Bank of Australia held interest rates at 4.75% following the latest council meeting with policy described as appropriate. The statement was slightly more dovish than previously with references to a weaker growth environment and this did have an impact in curbing demand for the Australian currency, especially as caution continued to prevail towards risk. In this environment, the Australian dollar weakened back to below 1.07 against the US currency.