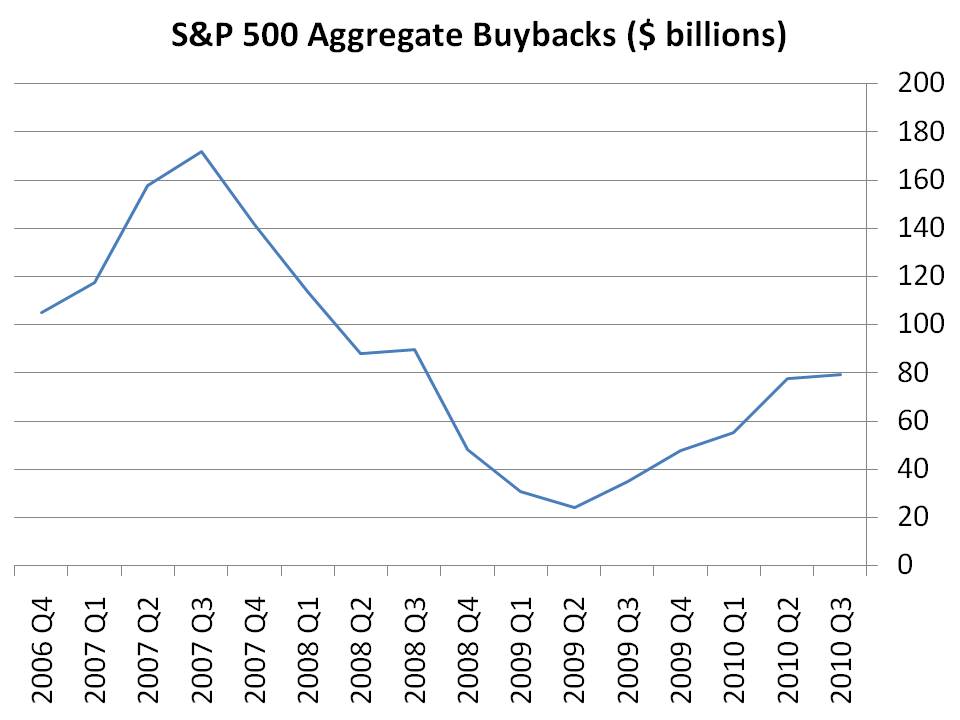

Corporations can be pretty poor allocators of capital. (As an aside, Warren Buffett’s ability to allocate capital towards its most efficient use is one of the major reasons his company has risen to the top. While every other company at the top had to invent something brilliant to get there, he got there just by properly allocating capital!) This chart provides an example of just how poor at allocating capital corporations are:

So when the market was booming, corporations were falling over themselves to buy back shares. When the market was cheap, corporations in the aggregate felt that buying back shares was a poor idea. (Of course, there were some corporations that were left in terrible financial shape and so they really couldn’t afford to buy back.)

Nowhere is this situation more egregious than at Netflix, where the company bought back its own shares at ridiculously high prices. Over the last year and a half or so, Netflix has traded with a P/E of between 60 and 90. Despite this, those in charge thought it made sense to spend not some, but all of the corporation’s earnings on share buybacks. In the last 1.5 years, Netflix has earned $290 million; it spent $305 million on buybacks over this same period!

As with all stocks trading at sky-high valuations, Netflix has since come down quite a bit. Its P/E is now barely over 30, suggesting a lot of those aforementioned repurchases have cost shareholders deeply.

This isn’t a case of 20/20 hindsight, however. It has been clear to value investors for some time now that Netflix shares were trading at an unreasonably high plateau. Even on this site, where generally only companies that are potentially undervalued are discussed, Netflix’s decision to buy back shares at astronomical prices was derided while they were taking place. Netflix was also featured on this site as a “buy” in an April Fools Day write-up, a great contrarian indicator! (As another aside, if things stay as they are, Amazon would make a great candidate for next year’s April Fools Day buy.)

There was one group, however, that made out well with the buybacks: those shareholders who sold their shares into the company’s over-priced buybacks. Company insiders, especially CEO Reed Hastings, were one such group. Netflix’s insiders have sold over $1 billion worth of stock in just the last two years! This reeks of impropriety.

Tax policies may also have played a role in how Netflix decided to return capital to shareholders. Dividends are taxed, whereas gains accruing to shareholders as a result of buybacks are deferred for tax purposes and often taxed at more favourable “capital gain” rates. However, in this case, the losses from the poor buyback decisions outweighed any tax consequences that may have applied. Fortunately, shareholders can protect themselves from buybacks at poor prices with a relatively obvious antidote: only buy shares in companies that are not ridiculously overvalued. Therefore, cross Amazon off your list!

Disclosure: No position