All eyes are on possible new historical all-time highs as the S&P 500 is closing in on 1,985.44.

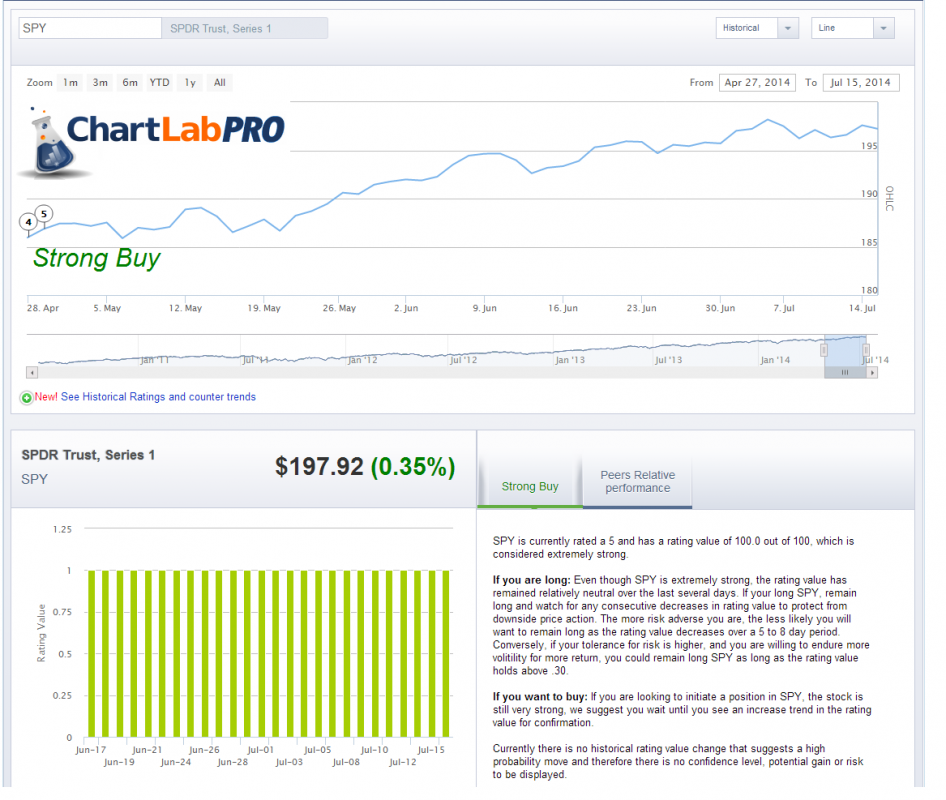

We have been telling readers since our Strong Buy call on April 29 as seen in the chart below. The S&P 500 is still surprisingly not overbought even at historic highs. Five weeks ago the Index had settled at 1923.00, and at that time we stated, “It appears investors would invite a test of the almighty 2000 region.

Subsequently, the high twelve days ago was 1985.44 (within 15 points of 2000.00). Four days prior to the Index posting the high within 15 points of the 2000 region (the Index had just settled at 1960.96), we stated, “The next 15- 25 points may prove to be the most interesting test of the last five years that this Bull run has been in place. Once it is possibly achieved, that region may be a psychological area of some degree of profit taking.”

The market traded up to 1985.44 (25 point rally- within our stated range), and then proceeded to sell off to 1952.86. Therefore we were correct in our assessment. 2000 remains on target, but holding a daily close above 1952.50 is critical.

Trading Plan

At this juncture, deploying new capital is far from a good risk/reward probability. However, letting existing positions run seems like a good bet until further notice or a breach of 2,000 on the S&P.

= = =

We have rolled out our new Free Watch list feature with some great proprietary features.