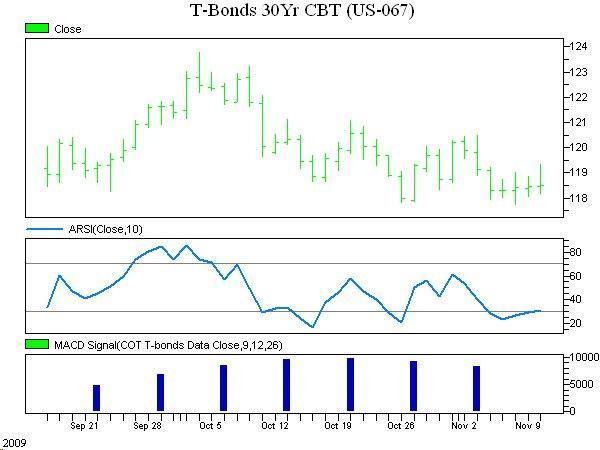

Here’s another example of the trades being published in “COT Signals.”

Commercial trader buying interest has increased on the market’s decline from 124 down to the current area around 118.

You can see the buying capacity of the commercial traders are expecting long term rates to remain low for the coming time period. While this may seem counter intuitive relative to the declining U.S. Dollar, it is clear from the unemployment report and the Federal Reserve Board’s comments that inflation is not a near term issue.

Back to the trade, we picked up buy signals on October 15th and 26th that had some short term staying power. This is typical of the turning of the tide in the trade. Perhaps we will pick up more on this one.

The ARSI has turned positive which indicates the swing low is in place. This morning, as per the newsletter, we are buying December 30yr Bonds and placing a protective sell stop at 117^22.

Please call with any questions.

866-990-0777