By: Scott Redler

Everyone has something to say about this market, but the bottom line is since the market gapped above 1060-1065 on September 1st and confirmed a new potential up move, we’ve seen very constructive action. Leaders have acted very well, lots of new highs, and many strategies to trade with some nice rotation between sectors. The market consolidated it’s big gains the prior week to open the door for a move back to 1128-1131. At this point, if you’re a market participant, stop complaining, and start working on your skills. The market is not giving money away but at least we have some action!

Tech

AAPL- Has acted much better after breaking back thru a small descending trend around 254-256, with our last cash flow buy through 260. Now it’s time to see if it can trade above it’s old highs and start the road to 300+. THEY NEED TO SPLIT THIS STOCK

AMZN- Stock is a monster. 126-127 was your core buy, then 139ish late last week was your momentum buy. Now it’s tough as it’s hitting some big resistance around 144-145

BIDU- Is on its way to Historic highs again, has a small pivot here around 85.50-86This stock gets above this and I’m sure we will see 88.32

GOOG- Not a market leader but has seen some select trades. This stock c.an work its way back to 500.

VMW- Has made new highs now about every 6 weeks. There is a negative piece in Barron’s. It has small support around 83 and bigger support in the 80 area.

CRM- Working on another upper flag- I’m not as excited here as I was with the bull flag through 112-114. I’m going to avoid this for a bit.

FFIV- Nice move above the 92-93 area and then tested that area Friday. I think it needs more time to re-set up.

CSCO-INTC-MSFT- Continue to lag- not much here yet for the cash flow trader.

Banks- Some news this morning lifting this sector

GS- Acting much better as it held our 144-145 support on that Monday pull-in and now is back above 150. It’s opening around 152 and could fill the open gap in front of it to 154-155. Hard to enter a long here now.

JPM- Quick Move back to 40-41. Pretty impressive, but I don’t think you initiate a new long here today

BAC- Back to 14ish in flash. The Potent move on Sept 1st woke it back up with 30,000 shares of CEO buying it has room to 14.20-14.50

NFLX- Remains a monster after a tiny pause late last week, we can now see 150+.

CMG- Great trade a few weeks back around 154. Now it can see a momentum move through 167.30.

POT- No new bid but looks okay in this upper range- perhaps hold small and just wait.

Casinos

LVS- Has been our bread and Butter from 19 this year- it’s opening at New Highs- But no trade here, just scale some back if your still long

WYNN- Working on a nice 6 month base- I had a tier one buy around 86 last week- I think you can add around 90.60 then above 94 will get us 100+

MGM- Stock is a dog BUT could see 11-11.50 but will be slow

OIH- Has been acting better – next resistance 109.75-110.50

WLT- Seems to have a nice set up- Buy price through 76-76.50

RIG- Was great on Friday for those in our Virtual Trade Floor

CCME- I am long this small Chinese stock from a sales trader. Could be a catalyst here by Wednesday or so. My stop is 8.50 and I will add above 9.60

Gold faced some resistance after a move from $1,160 back to $1,255ish- I did get stopped out of some. I’m in tier one long only now. Let’s see how market handles the big 1128-1132 resistance and see if Gold can stay above $1,220-$1,230

If you are a market participant in any capacity, You must start listening to the tape and not the excuses of those around you!

Every day is a work in progress in your career.

Be selective in your trades today as we open at monthly highs which always make for a tricky trade, usually a tier one at best. The time for tier 3-4 is behind us for now, as we extend into bigger resistance.

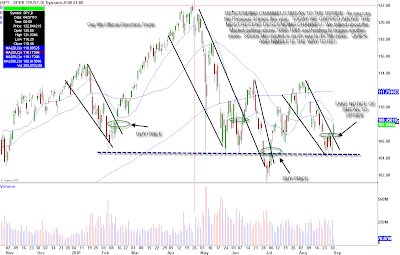

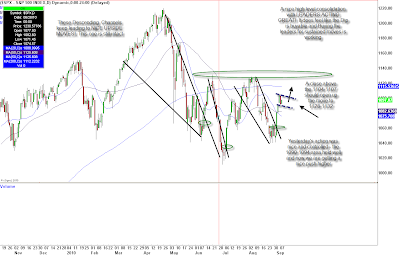

I’ve attached three important charts that I sent the day they took place. Look at these patterns.

September 1st

September 8th