By FXEmpire.com

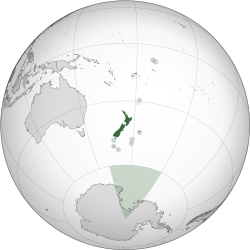

On the small pacific nation, consisting of two islands, known as New Zealand, the economy was set off in a tailspin this morning.

This small nation, where the people are fondly known as “kiwi”, the home of koala bears, and exotic flowers, the unexpected occurred.

The New Zealand unemployment numbers were released this morning showing that New Zealand’s unemployment rate unexpectedly rose to 6.7 per cent in the first quarter after the labor force swelled to a three-year high. The unemployment rate rose 0.3 percentage points in the three months ended March 31, from a revised 6.4 percent in the prior quarter, according to Statistics New Zealand’s household labor force survey.

The labor force participation rate rose 0.6 percentage points to 68.8 per cent, its second-highest reading on record and beating expectations of 68.3 per cent.

This lovely island nation depends on their trade with the larger Pacific nations, such as China, Japan and Australia. And above all they depend on tourism.

As the economic crisis continues to encompass most of the world, tourism around the globe has declined and the average spending by tourists has dropped. This is hardest felt in small nations depending on tourist dollars and even larger economies such as Greece, Spain and Italy, where growth is falling and tourism is lagging.

New Zealand also depends on their exports to their neighbors, in recent months New Zealand’s exports have declined along with other business between these neighboring countries.

Exports account for a high 24 percent of its output, making New Zealand vulnerable to international commodity prices and global economic slowdowns. Its principal export industries are agriculture, horticulture, fishing, forestry and mining, which make up about half of the country’s exports.

![]()

The April 26th statement from the Reserve Bank of New Zealand summed it all up nicely.

Reserve Bank Governor Alan Bollard said: “Inflation is restrained and is expected to stay near the middle of the Bank’s target range.

“The domestic economy is showing signs of recovery. Housing market activity continues to increase and a recovery in building activity appears to be underway, as forecast. That recovery will strengthen as repairs and reconstruction in Canterbury pick up later in the year.

“However, the global outlook remains of concern. Near-term indicators have moderated and financial market sentiment is still fragile.

“The New Zealand dollar has stayed elevated despite recent falls in commodity prices. Should the exchange rate remain strong without anything else changing, the Bank would need to reassess the outlook for monetary policy settings.

Click here to read NZD/USD Technical Analysis.

Originally posted here