The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Friday, June 04, 2010

Hours of daily research consolidated for you

Nice Currency Call, Mahmood

Don’t you just love when a guy who denounces you every ten seconds, calls you names, does everything he can to undermine you and dumps your currency and asks others to do the same is forced to buy the dollar back because his beloved euro has crashed. Iran, in the proud market savvy tradition of gold maven countries Britain and Canada who dumped their gold at the bottom of the market which they helped create by announcing their intentions to sell, has announced the will be selling $45 billion in Euros over the next 3 months and will want their customers to begin remitting again in dollars. Shrewd.

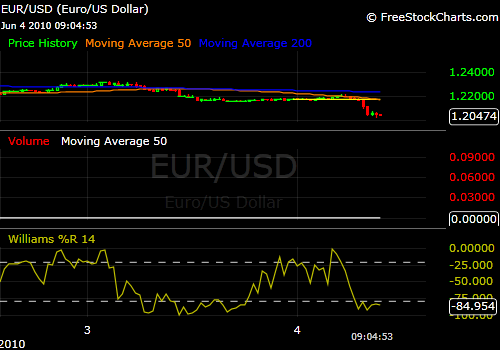

The Euro is hitting multi-year lows this morning on fears that Hungary will default on its debts. There is also sound bites about derivatives issues concerning Societe General with no clarification or detail at this moment.

The highly anticipated jobs report this morning showed the contrast between the Administration and Mr. Market. President Obama was out on Tuesday talking about what a strong report it was going to be. VP Joe “BFD” Biden echoed the President’s pump-priming. When the announcement was made an already negative futures market tanked when the numbers were released. The Dow dropped an additional 130-140 points in under a minute to minus 200. Of 430,000 jobs created in April, 409.000 were temporary census workers. Being the creative political genius that he is, I expect the President to eliminate unemployment completely by developing a package of “jobs” for ever single person in the United States to do a cornstalk census, a seashell census, a tree census broken down by species, a blade of grass census, a grain of sands on the beach census and any number of other socially important undertakings all to be paid for by taxing the remaining 27 productive people in the United States of America who do not work for the government.

Germans who have had their currency and any assets they held denominated in that currency totally destroyed and made worthless twice in the last century are taking their savings out of gold. Other people are apparently reacting the same way because despite a decline from the $1249.50 high on May 12th, the gold holdings of the ETF GLD increased by 21.3 tons yesterday to a new record level and brought the increase, since the peak price day, to 80 tons (the article used the more imposing tonnes but I don’t want to be accused of hyperbole).

In addition to the problems with the forint, the government of Romania had a failed auction of 600 million leis (about $175 million) when investors wouldn’t buy the bonds at a level of interest that was acceptable to authorities. My suspicion is that, like the Greeks, borrowers, with hat in hand and empty stomachs, will learn that they do not dictate the terms to lenders.

As you begin to see more and more governments policies and programs fail to deliver results consider whether you should continue to place your trust there or decide to own some physical gold and silver.

Oh, the Labor Secretary and CNBC people are telling us that the employment report really is good news-so what does Mr. Market know?

JohnR

Goldensurveyor.com