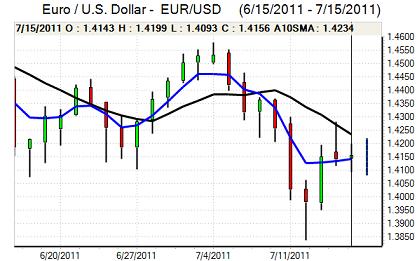

EUR/USD

Caution prevailed ahead of the stress-test results on Friday. The US headline consumer inflation report was weaker than expected with a 0.2% monthly decline, but there was a stronger than expected core reading for the second successive month with a 0.3% rise. The New York PMI manufacturing index registered the second consecutive reading below zero for the first time in over two years despite a small monthly improvement.

There was also a further decline in the University of Michigan consumer confidence which will cause alarm, especially as energy prices have been falling.

There was no breakthrough in the US debt-ceiling talks with President Obama and congressional negotiators unable to reach any agreement. There will an additional sense of urgency this week given that credit-rating agencies have indicated that the AAA credit rating will be forfeited if there is no agreement by August 2nd.

Eight banks were deemed to have failed stress tests for European banks while another 16 needed to raise capital to bring capital adequacy levels to an acceptable standard. Markets remained unconvinced by the results, especially as the scenarios tested only included a 15% haircut on Greek bond holdings and that the implications of a full-blown Greek default were not tested. There will be further fears over the European banking sector as credit conditions deteriorate

Markets will also demand a much more decisive stance on Greece at a Summit meeting due this Thursday. ECB President Trichet again attacked the idea of Euro-zone bonds over the weekend and also warned over the implications of a Greek default, warning that Greek collateral would not be accepted. Despite initially rising on Friday following the stress tests, the Euro retreated to below 1.41 in Asia on Monday as fear tended to dominate.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to below 79 against the yen during Friday, but was unable to make any significant headway with resistance close to 79.30.

The US growth-oriented data was generally disappointing with weaker than expected reading for consumer confidence and industrial production which will continue to sap potential yield support. There will also be fears over the US default risk which could spur capital repatriation.

Domestically, markets will remain focussed on the potential for intervention, especially with the Japanese currency still stronger than the 80 level. There were no confirmed reports of intervention during Friday and Tokyo was closed for a holiday on Monday which limited any potential Bank of Japan action. There will still be caution over aggressive speculative long yen positions.

Sterling

Sterling hit resistance close to 1.6170 against the dollar during Friday and generally drifted weaker in choppy trading conditions and tested support below 1.61 on Monday. There was a firm tone against the Euro as the UK currency pushed to a 1-month high beyond 0.8750.

After a week without major economic releases, UK developments will receive greater attention this week with the Bank of England minutes on Wednesday while the latest government borrowing data is scheduled for Thursday.

Underlying confidence in the UK economy remains weak with the ITEM forecasting group, for example, cutting its 2011 GDP growth forecast to 1.4% from 1.8%. Any shortfall in growth would maintain pressure for extremely low interest rates and would also undermine the government’s budget targets.

The contagion risk will also be watched very closely as Sterling could be subjected to heavy selling pressure if confidence in the UK’s ability to curb the budget deficit is damaged.

Swiss franc

The Euro failed to gain any relief against the franc on Friday with a slide towards 1.15 against the franc and it gapped lower again on Monday with fresh record lows below 1.1450. The US currency also remained under pressure with a renewed test of support below 0.81.

Safe-haven considerations have continued to dominate with the Swiss currency gaining renewed support from fresh fears surrounding the Euro outlook with Euro-zone leaders still battling to secure a fresh rescue package for Greece. Markets remain highly sceptical of the approach which triggered further flows into the franc.

There were some rumours on Friday that capital controls could be introduced and markets remained very sensitive to National Bank comments.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support close to 1.0620 during Friday and rallied back towards 1.0680, but the underlying tone remained defensive and there was a test of support below 1.06 in local trading on Monday. There was a shift in interest rate expectations which undermined the currency as one prominent investment bank forecast a rate cut late this year.

Underlying risk appetite also remained fragile as Euro-zone and global growth fears persisted and this also curbed buying support for the Australian dollar, especially as confidence in the domestic economy has also deteriorated.