Yesterday, the Federal Reserve announced there was no change to the so called “Quantitative Easing 3” program. Since many market participants were expecting a $10B-$15B tapering of the monthly asset purchases, shares of the SPDR Gold Trust Shares (GLD) dropped over 8% from the August highs heading into the Fed’s meeting.

The taper was not only delayed this month, but it might not take place until the beginning of next year. This means easy money is here to stay and inflated asset prices will last for the time being. Look for gold prices to rise over the next few months or until Fed slows down the $85B per month of monetary easing.

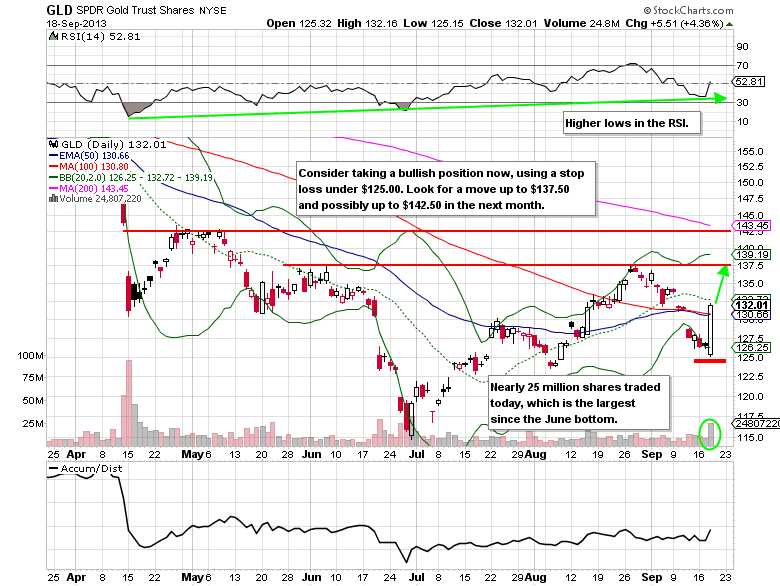

TECHNICAL PICTURE ON GOLD

The SPDR Gold Trust Shares (GLD) ETF rose 4.36% on nearly 25M shares traded, which is the largest since the June bottom. This type of price action sets up for a low risk buying opportunity to trade against. (GLD) will likely test the $137.50 resistance level in the next two weeks and possibly up to the $140-$142.50 level in the next month.

SPDR GOLD TRUST SHARES (GLD) OPTIONS TRADE IDEA

Buy the (GLD) Oct. $132/$140 Call Spread for a $2.55 debit or better

(Buying the Oct. $132 Call and Oct. $140 Call, all in one trade)

Stop loss: None

Upside target: $7.50-$10.00

= = =

Check out another trade idea from Mitchell here.