EUR/USD

The Euro was again subjected to choppy trading during Tuesday and after finding support just below the 1.4250 level, it rallied strongly to a high near 1.44.

EU officials continued to insist that there was no Plan B for Greece and that failure to approve the austerity package on Wednesday would block any further support for Greece and effectively trigger a debt default. The comments were also aimed at maximising pressure on the Greek government to bring potential rebels in line and secure the necessary majority.

There was greater market optimism over a yes vote which provided significant Euro support, especially when there was a wider improvement in international risk appetite. China also continued to pledge support for the Euro-zone which curbed selling pressure

There were still important concerns surrounding the financial sector with reports that up to 15 Euro-zone banks could fail the stress-test results which are due in the second week of July. The Greek General Strike also caused important tensions surrounding the vote while the main opposition party still insisted that it would vote no.

ECB president Trichet stated on Tuesday that the central bank remains in strong vigilance mode which continued to suggest that the central bank would push ahead with the planned interest rate increase next week. The Euro continued to gain some support on yield grounds with the Fed keeping interest rates at extremely low levels.

The US consumer confidence data was weaker than expected with a decline to 58.5 for June from a revised 61.7 with the dip in energy costs not having any immediate positive impact on sentiment. The Euro drifted in narrow ranges during Asia on Wednesday.

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on a dip to below 80.70 against the yen on Tuesday and rallied firmly to a 4-week peak just above 81.20 before stalling. Although the US data was weaker than expected, there was a rise in US Treasury yields which helped to underpin the dollar to some extent.

There was a general improvement in risk appetite which also curbed defensive demand for the Japanese currency with evidence that speculative dollar demand was still strong from domestic investors.

The industrial production data was slightly stronger than expected with a 5.7% monthly increase which maintained expectations of a slow recovery in the economy and this also helped stem pessimism over the global outlook.

Sterling

Sterling continued to hit selling pressure above 1.60 against the dollar during Tuesday and also weakened to lows near 0.8980 against the Euro, but it did find support close to recent lows of 1.5910 against the US currency.

There was no revision to the first-quarter GDP data, in contrast to some hopes for an upward revision while the current account deficit narrowed to GBP9.4bn for the first quarter of 2011 from a revised GBP13.0bn previously.

Bank of England testimony on the inflation report and monetary policy was the main focus during the day. As expected, there was a wide range of comments during the hearings and there will certainly be the threat that divisions will intensify over the next few months.

The underlying message was that interest rates would remain at very low levels. MPC members were, however, also keen to play down the possibility of any further quantitative easing with Governor King stating that further bond purchases could be seen as taking the easy option. The comments did help curb more aggressive Sterling selling.

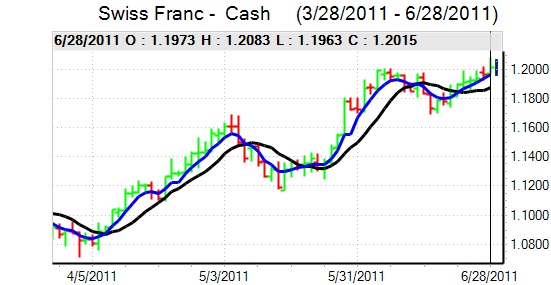

Swiss franc

The dollar was subjected to further selling pressure during Tuesday and retreated to fresh record lows below 0.83 against the Swiss currency before finding support. Although there was greater optimism that the Greek parliament would back austerity measures, the Euro was unable to strengthen above 1.20 against the Swiss currency.

There was a stronger than expected reading for the UBS consumption index which helped to boost confidence in the economy. There was also some evidence of corporate franc demand ahead of the quarter-end. There will be further volatility following Wednesday’s Greek vote and any rejection would trigger further aggressive franc buying.

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support close to 1.0440 against the US currency on Tuesday and rallied to a high close to 1.0550 during Asian trading on Wednesday. There was a tentative improvement in risk appetite on hopes that Greece would approve its austerity package which helped underpin the currency as equity markets rallied while the US currency also lost wider support.

Further speculation that the Chinese central bank would take a more cautious attitude towards tightening monetary policy further also helped underpin the Australian currency with yield support still helping to sustain buying support on dips.