We’re still waiting for a clear signal.

The S&P is finally over our 1,359 level but, so far, has not stayed over that line for a full session and we need two sessions over the line to confirm it. However, I did promise not to be bearish if we’re over 1,360 and I think I got it all out of my system in the last few posts, as well as last night and this morning’s Member Chat, where I outlined my case for for the oil glut and the collapse of the EU, which will lead to the collapse of Asia and the US – but not today.

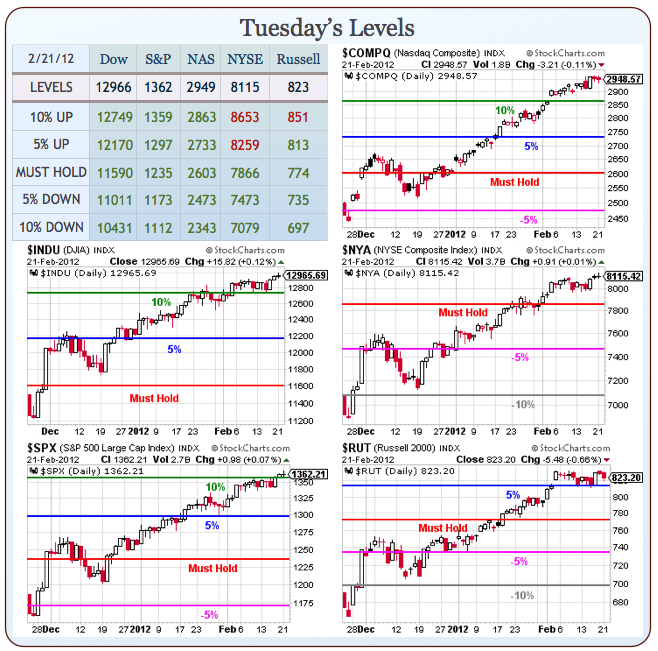

Today there is a ton of money sloshing around in the system and we are clearly in a massive technical rally, which may (or may not) end at any moment. We discussed our February trade ideas from our morning posts on Monday’s morning so I won’t rehash them here but I do want to take a look at ways to leverage some trades to take full advantage of this non-stop rally as we have VERY CLEAR stop lines (our 10% lines) where we’ll have a clear signal to get out or cover if ANY of the major indexes fail.

As with our early February trade ideas, we can add one more bullish trade each day that we’re over the line and cash out the older trades that go well in the money and, of course, accumulate some Disaster Hedges (20-30% of your unrealized profits into protective hedges is a good rule of thumb as well as the cheapest form of protection – STOPS!).

My favorite disaster hedges are playing for a correction in the Dow or the Nasdaq which, if you are a Dow Theorist, would seem very likely based on the chart on the left but, so far, nothing matters to the bulls – who have their story and they are sticking to it – regardless of those pesky facts. Sorry, that’s a bit bearish (bad habit). Anyway, my favorite disaster hedges are:

SQQQ April $13/17 bull call spread for .70. This trade has a 471% upside potential by itself if SQQQ (currently $13.14) gains 30% by April expiration (58 days). That’s a lot but SQQQ is a 3x ultra-short to the Nasdaq so a 10% drop in the Nas, back to 2,650…