| 2013 is Just Around the Corner

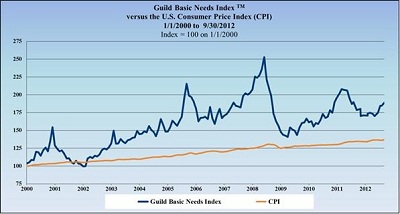

Many changes in the business and financial sectors are expected in 2013. Let Guild Investment Management help you find the right investments to reach your investment goals. To inquire about the services we offer, please call Aubrey Ford at (310) 826-8600. All Eyes on the Fiscal Cliff The front pages of many global financial publications this week have trumpeted the problems that await the U.S. if a compromise over the fiscal cliff does not take place. Early signs from both U.S. political parties indicate that although they talk compromise, it is merely for public consumption; neither has been willing to compromise thus far. Fear of Tax Increases and Spending Cuts in U.S. We believe that the direction of the U.S. market is easy to see. If compromise reigns — and we believe that it won’t until after January 1, 2013 — the markets will rise. We believe that U.S. politicians will be negotiating until January 1, 2013, or beyond, and that the cliff resolution will not be reached until sometime in January. In this case, U.S. stocks may move down or sideways through year’s end. If compromise turns into acrimony, regulatory pressures on business continue, and are combined with the much higher taxes as were proposed by President Obama in his news conference yesterday (he proposed raising taxes by $1.6 trillion rather than the $800 million he had previously proposed in Summer of 2011, which the market had expected), we anticipate a poor U.S. stock market for the next few months. In our opinion, investors will find opportunity in some foreign markets and in gold. Question: What about Jobs? Job growth has been the U.S. economy’s main problem since 2008. It has been anemic; only 195,000 net new jobs have been created in the last four years. Optimists expect that many new jobs will be opened up by the retirement of baby boomers, the eldest of whom are now are 66 years old. While we hope that jobs will be created in the coming period, many who had planned to retire cannot generate enough income from their savings to retire at the standard of living that they require. Potential retirees had expected their social security check to be supplemented by the income from their IRA and 401K plans. However, when they look at the returns available to these plans from traditional income investments; they do not see enough income to allow them to live comfortably. We do not need to tell you that checking and savings accounts pay less than 1/4 of 1 percent, and that 5-year government bonds pay less than 1 percent. Meanwhile, taxes are rising on sales, income, and real estate. It is not surprising that many feel insecure about letting go of their jobs — and choose to continue to work. Our advice to those leading-edge baby boomers in their 60?s… perhaps you should not retire yet. Where are retirees supposed to go for income? Government bonds? CDs? Municipal bonds? Savings accounts?… To reiterate the point above, money markets and bank accounts pay almost nothing. The alternative asset class (bonds) that people have traditionally used for income investing does not in our opinion have adequate potential reward given the risk to investors’ capital. Find out how Guild invests for income in the current financial environment in this week’s premium global market commentary. Upgrade your complimentary subscription today. Learn about the benefits of Gold Subscription by contacting our office at (310) 826-8600. Growing U.S. Competitiveness Fuelled By Cheap Energy The dramatic decline in energy prices driven by the U.S. revolution in unconventional natural gas production is causing alarm in Europe. Some of Europe’s large manufacturers, such as the German giants BASF and Bayer, are afraid that cheap energy from shale gas will drive new high-value-added manufacturing investment to the U.S., and away from Europe... Guild Basic Needs Index In this week’s Premium Global Market Commentary available for Gold Subscribers, we also discuss:

To get the full content and much more, become a Gold Subscriber today to receive our weekly Premium Global Market Commentary, where we discuss our formulated plans and investing strategies. Learn about the benefits of Gold Subscription by contacting our office at (310) 826-8600. Guild Recommendation Tracker |

|

If your firm uses soft dollar arrangements to pay for research, please contact us to discuss how to soft dollar your Gold Subscription. |

Stocks

www.gbni.info

www.gbni.info