The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Tuesday, June 2, 2010

Hours of daily research consolidated for you

Numb is not Dumb

Reviewing the day’s activity and searching for clues about what may happen going forward, I am struck by my own lack of insight. After thinking about that for a while, I have come to the conclusion that maybe there are none to be had right now…the political chaos that is engulfing the world (add the resignation of Japanese Prime Minister Hatoyama yesterday to the list after about 1 year in office), the raging debate of the deflation/inflation camps, the demographics of baby boomers racing toward retirements with home values and the 401ks, IRAs which they relied on for retirement turned upside down, the Gulf oil disaster, all drain one’s mental and emotional energy as looks for opportunity.

The market reflects this: the SPY on a 10 minute chart yesterday..

The bad start to the day after Friday’s bad close, up down, up down, down Down DOWN to end the day on HUGE volume in the last 10 minutes.

Part of what you think is influenced by how other’s feel and the actions taken they take as a result of that feeling(s).

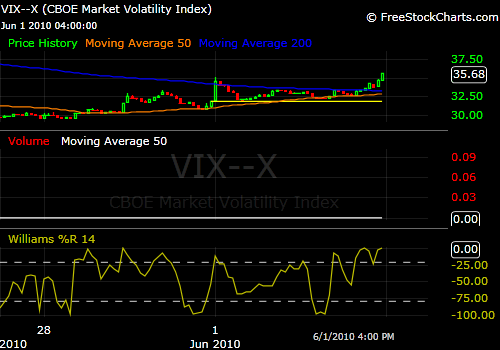

The VIX yesterday: 1o minute chart-the action here inversely correlates with the market’s move.

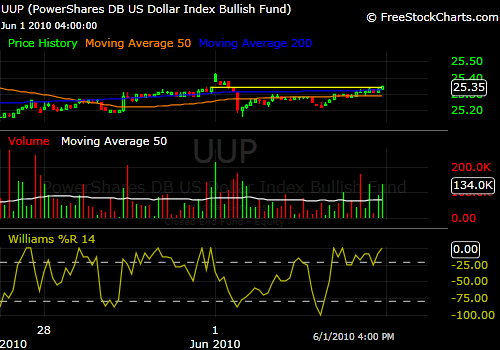

The Dollar-10 minute chart-correlation follows the pattern of past months. Not as precisely or to the extent of the SPY and VIX.

The GLD gold etf usually moves opposite the dollar: 10 minute

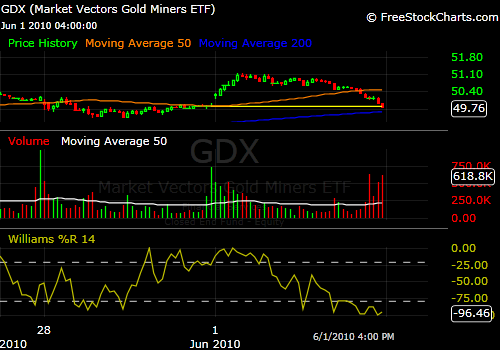

Gold up, the GDX gold miner’s etf usually rise as well, especially on a gap-up in gold. Ended on bad note like the spy and on bigger volume.

Rising Libor rates and TED spreads may be showing inter-financial institutional fear, especially in Europe, and may be showing declining liquidity which causes everything to be sold…which might account. Commodities in general got smashed so the reliance of many gold and silver miners on by-product lead, zinc, and copper may also be the driver here.

For sure, the announcement that the US Attorney General Eric Holder is contemplating civil and criminal action against British Petroleum was thought to be a trigger for the late day sell-off. The former CEO of BP, whom the British have knighted and persist in address as Lord Browne, was responsible for the refinery explosion in Houston that killed 14 a couple of years ago because of budget-cut mandated safety measure cuts and was in charge when this disaster was implanted. Tony Hayward is taking the heat, Browne lit the fire.

The Oil Service Holders: A Daily Chart…bottom no closer than capping the BP well.

Asia was negative last night, Europe is down over 1%, US futures are positive and gold is down about $5 bucks but still in the $1220s.

Demand for physical gold and silver continues at record levels.

This will unravel and unfold and provide some evidence about how to proceed in the near term. Physical gold and silver seems to have engendered some confidence about the longer term. Physical might be dumb but when I’m numb, I like dumb

JohnR

Goldensurveyor.com