By FXEmpire.com

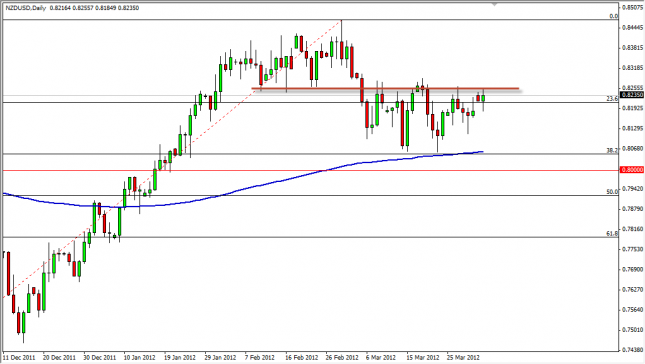

The NZD/USD pair fell during the Monday session, but bounced in the end to form a hammer. The pair has been bullish for some time, but has recently found itself in a bit of a pullback. The hammer signals that the market will more than likely try the 0.8250 level again, and we think that a daily close above this resistance level is a good enough signal to go long.

The 200 day EMA is just below, so we can see the trend traders jumping in as well. The 0.80 level is also supportive, and the handle is between the 38.2 and 50% Fibonacci level. The pair will move with the overall commodity market, so bullish moves there will support the bulls in this market. We buy on a daily close above the 0.8250 mark, and won’t sell until we clear the 0.80 by a large margin on a daily close.

NZD/USD Forecast April 3, 2012, Technical Analysis

Originally posted here